Need funds quickly for an emergency or personal goal? Tata Capital offers personal loans that are fast, flexible, and tailored for today’s needs. Whether it’s a wedding, home renovation, education, or a medical urgency, a personal loan from Tata Capital can be your financial cushion.

Let’s break down everything you need to know about Tata Capital Personal Loans—from features and eligibility to interest rates, documentation, and tips from RupeeQ for a smooth borrowing experience.

What is a Tata Capital Personal Loan?

Tata Capital provides unsecured personal loans ranging from ₹40,000 to ₹35 lakhs, which can be used for multiple personal expenses. No collateral is required, and the process is fully digital, making it fast and hassle-free. The loan tenure can go up to 6 years, allowing borrowers to repay in convenient EMIs.

Example:

If you borrow ₹2 lakhs at 12% interest for 3 years, your EMI would be around ₹6,641 per month.

Key Features of Tata Capital Personal Loan

Below are the main highlights of what you get with Tata Capital:

| Feature | Details |

| Loan Amount | ₹40,000 to ₹35,00,000 |

| Interest Rate | Starts from 11.99% p.a. |

| Tenure | Up to 6 years |

| Processing Fee | Up to 5.5% of loan amount + GST |

| Approval Time | Instant (subject to eligibility) |

| Collateral Required | None |

| Disbursal Mode | Online transfer to your bank account |

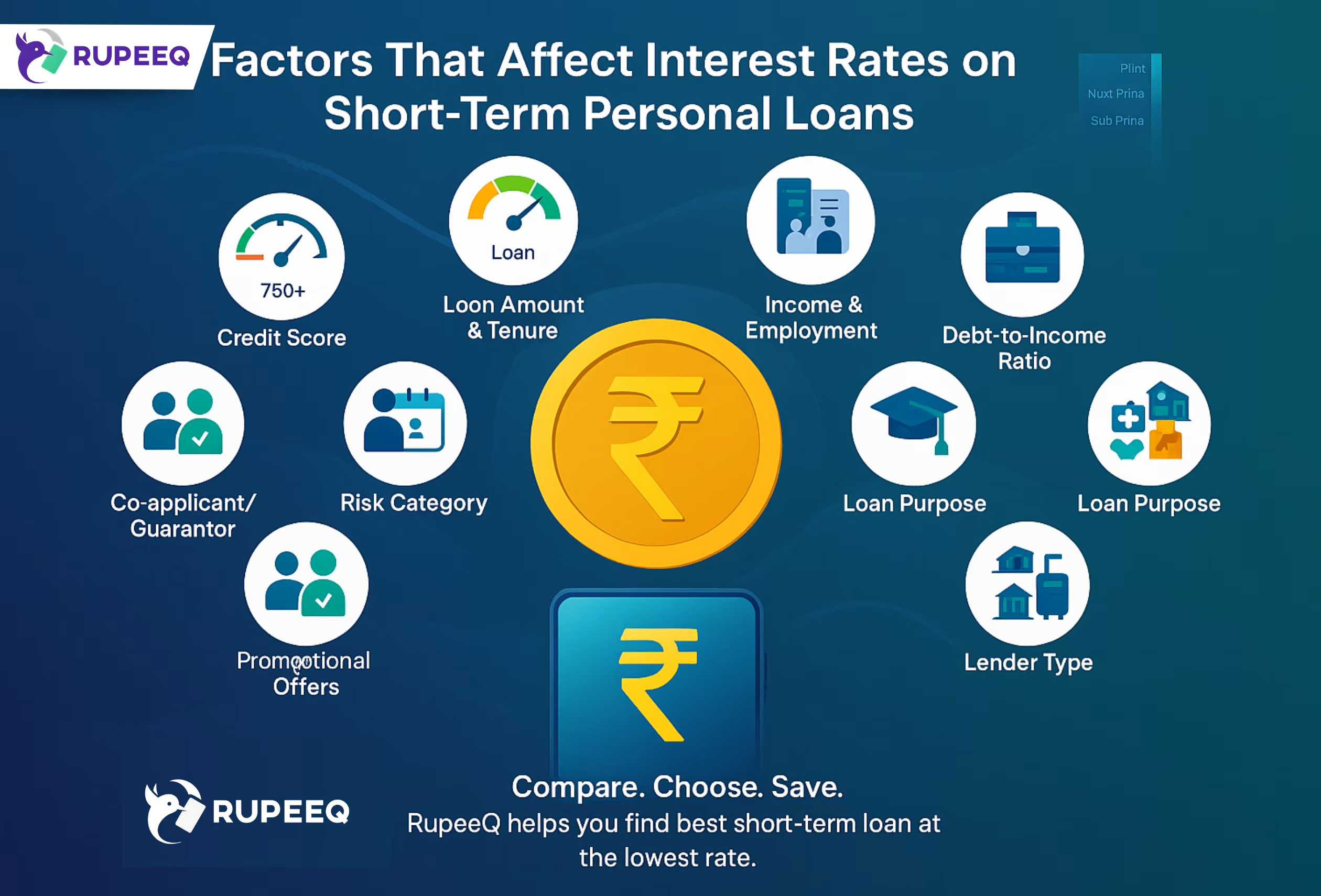

RupeeQ Tip: If your credit score is above 750, you may be able to negotiate for a lower interest rate or faster disbursal.

Tata Capital Personal Loan Eligibility Criteria

To apply for a personal loan from Tata Capital, you must meet the following basic eligibility criteria:

For Salaried Individuals:

- Age: 21 to 58 years

- Minimum Income: ₹15,000 per month

- Work Experience: Minimum of 1 year in current job

Your credit score, debt-to-income ratio, and employer profile may also influence your eligibility and loan amount.

RupeeQ Tip: Before applying, check your free credit score on RupeeQ ACE to avoid surprises during approval.

Documents Required for Tata Capital Personal Loan

Here’s the list of documents you’ll need to keep ready:

- Identity Proof: Aadhaar Card / Passport / Driving License / Voter ID

- Address Proof: Aadhaar Card / Passport / Driving License / Voter ID

- Income Proof: Salary slips for the last 2 months

- Bank Statement: Last 3 months of salary account statement

- Employment Certificate: Proof of at least 1 year of continuous employment

Tata Capital Personal Loan Interest Rates and Charges

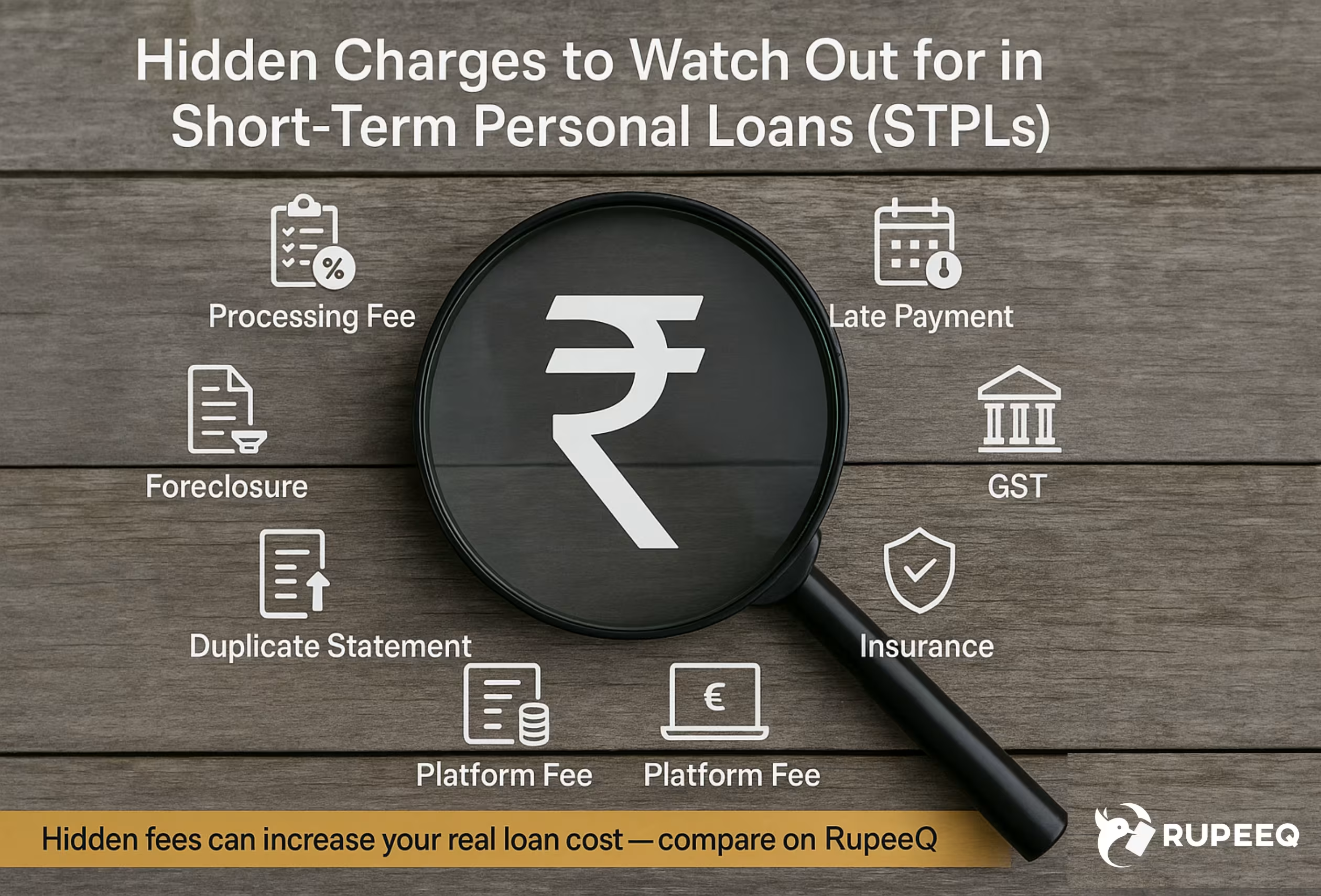

Understanding the cost of your loan is important before you commit. Tata Capital offers competitive rates, but there are a few additional charges you should be aware of.

| Charge Type | Amount |

| Interest Rate | Starting from 11.99% p.a. |

| Processing Fee | Up to 5.5% + GST |

| Late Payment Penalty | 3% per month on overdue amount |

| EMI Cheque Bounce Charge | ₹600 per instance |

| Loan Cancellation Charges | 2% of loan amount or ₹5,750 (whichever higher) |

| Swapping eMandate/Post-dated Cheques | ₹550 + GST per swap |

| Hard Copy Statement | ₹250 + GST |

| Duplicate NOC or Schedule | ₹550 + GST per copy |

RupeeQ Tip: Opt for digital statements to save unnecessary charges. Most of these are free if downloaded online.

When Should You Consider a Tata Capital Personal Loan?

Tata Capital Personal Loan can be ideal in the following scenarios:

1. Medical Emergency

When you need immediate funds for hospital bills, Tata Capital’s quick disbursal helps manage unplanned expenses.

2. Wedding Expenses

Cover venue, catering, travel, and other costs for a big fat Indian wedding without draining your savings.

3. Home Renovation

Turn your dream home into reality with funds for interior upgrades or structural improvements.

4. Education Needs

Finance tuition fees, coaching classes, or certification programs.

5. Debt Consolidation

Repay high-interest loans or credit card dues with a lower-interest personal loan.

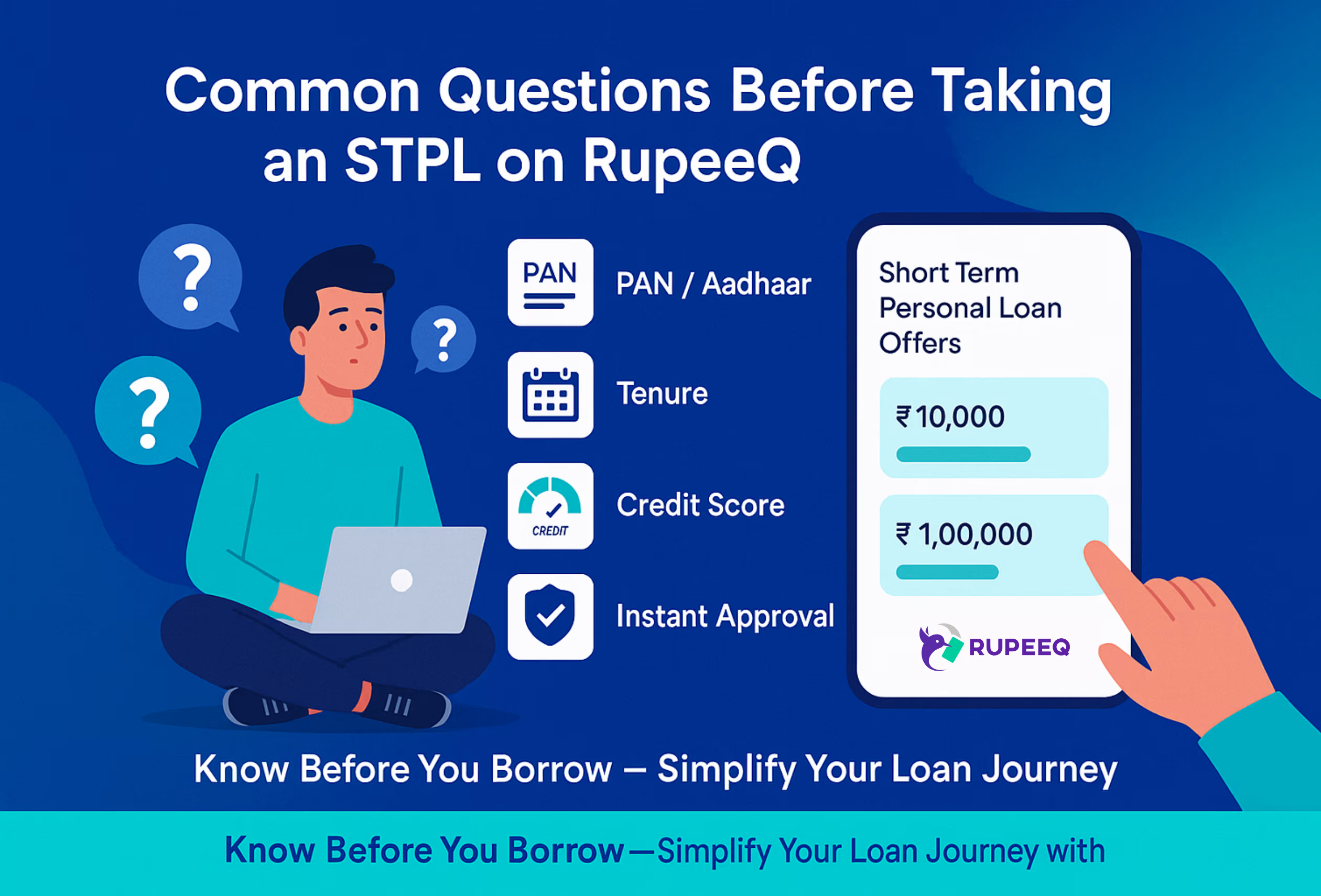

How to Apply for Tata Capital Personal Loan via RupeeQ

Applying for a personal loan has never been easier. Here’s how you can do it via RupeeQ:

Step-by-Step Process:

- Visit RupeeQ Website

Go to the personal loan section and click on Tata Capital Personal Loan. - Check Pre-Approved Offers

Based on your profile, see if you are eligible for instant approval. - Fill Basic Details

Enter name, contact, income, employment, and PAN. - Upload Documents

Submit scanned copies of your KYC and income proof. - Get Instant Decision

Based on your credit profile, Tata Capital will approve or suggest alternate offers. - Loan Disbursal

If approved, funds are transferred to your bank account, usually within 24–48 hours.

RupeeQ Tip: If your application is rejected, try applying for a smaller amount like ₹50,000. Timely repayment can improve your credit score for future eligibility.

Pros and Cons of Tata Capital Personal Loan

| Pros | Cons |

| Quick online process and disbursal | Processing fee can be on the higher side |

| No collateral required | High penalty for delayed EMI payments |

| Flexible tenure up to 6 years | Interest rates depend on credit profile |

| Transparent charges listed upfront | Pre-closure may attract additional charges |

Tata Capital Personal Loan is a reliable option for salaried professionals needing fast access to funds for personal purposes. With its digital-first approach, wide loan range, and flexible repayment options, it caters well to modern Indian borrowers. However, it’s important to read the fine print and assess your repayment capacity before applying.

FAQs on Tata Capital Personal Loan

- What is the minimum and maximum loan amount I can get from Tata Capital?

You can get anywhere between ₹40,000 to ₹35,00,000 based on your eligibility. - How long does it take for Tata Capital to disburse a personal loan?

If all documents are in order, the loan is usually disbursed within 24 to 48 hours. - What happens if I miss an EMI payment?

A late payment charge of 3% per month on the defaulted amount is levied. - Can I pre-close my Tata Capital Personal Loan?

Yes, but pre-closure charges may apply. It’s advisable to check with Tata Capital directly.

5. How do I check my eligibility before applying?

You can check your free credit score on RupeeQ to get an idea of your chances of approval.