Small lifestyle loans have quietly become a part of everyday spending. Buying a smartphone on EMI, converting a credit card bill into instalments, financing furniture, or taking a short-term personal loan for travel or gadgets feels normal today. These loans are easy to access, quick to approve, and appear harmless because the amounts are small.

However, what many borrowers do not realise is that small lifestyle loans play a much bigger role in shaping long-term credit health than their size suggests. Even when repayments are on time, repeated use of such loans can influence how lenders see your financial behaviour years later.

In this blog, we will explain what small lifestyle loans are, how they appear in your credit profile, their long-term impact on credit health, and how to use them responsibly without limiting future loan opportunities.

What Are Small Lifestyle Loans?

Small lifestyle loans are short-term, usually unsecured credit products taken for non-essential or semi-essential spending.

Common Examples

- Mobile phone or gadget EMI

- Furniture and appliance loans

- Travel or holiday loans

- Education gadgets financed through EMIs

- Credit card EMI conversions

- Small-ticket personal loans under ₹2–3 lakh

These loans are designed for convenience, not long-term financial planning.

Why Lifestyle Loans Feel Harmless

Lifestyle loans are attractive because:

- EMIs look affordable

- Approval is quick

- Documentation is minimal

- Payments feel manageable

A ₹2,000 or ₹3,000 EMI rarely feels risky on its own. The issue arises when multiple such loans accumulate quietly over time.

RupeeQ Tip:

The size of the EMI matters less than the pattern it creates in your credit behaviour.

How Small Lifestyle Loans Appear in Your Credit Report

From a credit bureau perspective, there is no category called “small” loan.

What Credit Bureaus Record

- A new loan account

- Loan amount and tenure

- EMI obligation

- Repayment behaviour

- Closure or settlement status

Whether the loan is ₹25,000 or ₹5 lakh, it contributes to your credit profile.

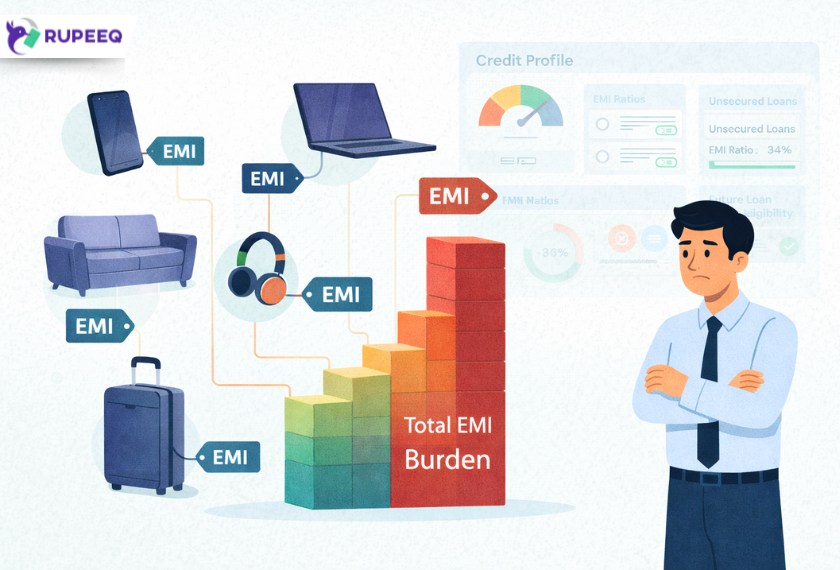

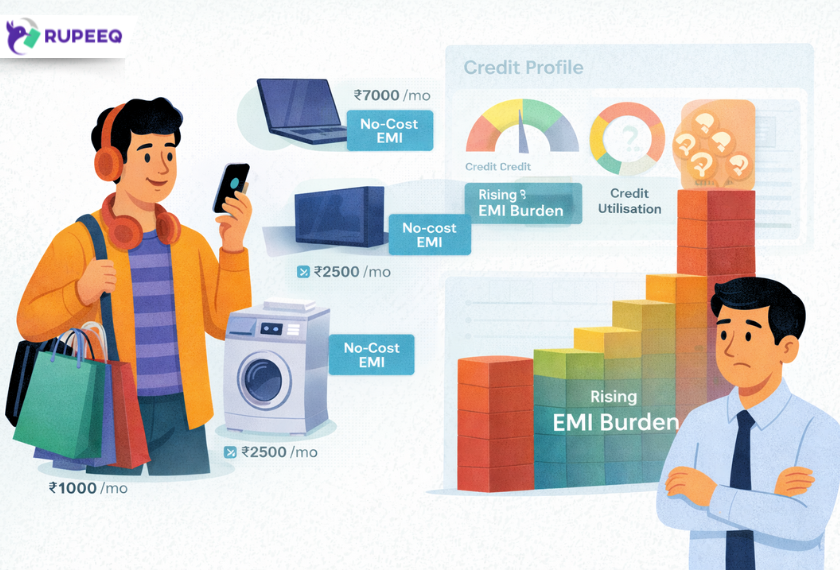

Impact 1: Gradual Increase in EMI Burden

One of the biggest long-term effects of lifestyle loans is EMI stacking.

Example:

| Loan Type | EMI |

| Smartphone EMI | ₹2,500 |

| Laptop EMI | ₹3,000 |

| Furniture Loan | ₹2,200 |

| Travel Loan | ₹3,300 |

| Total EMI | ₹11,000 |

If monthly income is ₹40,000, over 27 percent of income is locked into lifestyle spending.

Why This Matters

- Lenders track EMI-to-income ratio closely

- Higher EMI burden reduces future eligibility

- Even timely repayments may not offset risk perception

Impact 2: Lifestyle Loans Increase Unsecured Credit Dependence

Most lifestyle loans are unsecured.

What This Signals to Lenders

- Borrowing for consumption

- Dependency on credit for lifestyle maintenance

- Limited financial buffer during emergencies

Long-Term Effect

A profile dominated by unsecured lifestyle loans appears riskier than one with structured credit, even if credit score remains stable.

RupeeQ Tip:

Unsecured lifestyle credit should supplement income, not replace savings.

Impact 3: Multiple Loans Reduce Credit Profile Quality

Credit health is not just about repayment history. It is also about credit quality and structure.

Example Comparison

| Profile A | Profile B |

| 1 home loan + 1 card | 6 lifestyle loans |

| Same income | Same income |

| Same credit score | Same credit score |

Lenders often prefer Profile A because:

- Fewer obligations

- Clear financial planning

- Lower behavioural risk

Profile B may face:

- Lower loan limits

- Higher interest rates

- Stricter approval checks

Impact 4: Frequent Lifestyle Loans Trigger Repeated Credit Enquiries

Each new lifestyle loan usually involves:

- A fresh credit check

- A new enquiry on your report

Over Time This Leads To

- Higher enquiry count

- Slower credit score improvement

- Perception of credit hunger

Even if enquiries do not cause major score drops, they weaken lender confidence during large loan assessments.

Impact 5: Lifestyle Loans Can Hide Financial Stress

Because EMIs are small, borrowers often underestimate their impact.

Common Behaviour Pattern

- Convert expenses into EMIs

- Use EMIs to manage cash flow

- Delay saving due to EMI commitments

This creates a dependency cycle where lifestyle expenses are continuously funded by credit.

Lenders interpret this as:

- Limited savings discipline

- Cash flow pressure

- Higher default risk during income disruption

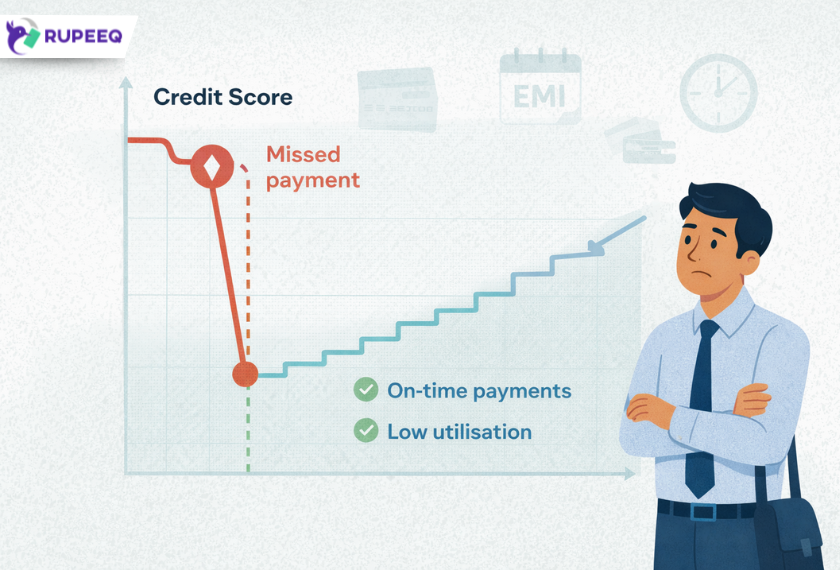

Impact 6: Missed Payments Hurt More Than Expected

Lifestyle loans are short-term and frequent, making them easy to forget.

Why Missed EMIs Are Common

- Multiple due dates

- Small amounts seem non-urgent

- Auto-debits fail due to low balance

Credit Impact

- Even one 30+ DPD can cause a sharp score drop

- Recovery takes months

- Impact outweighs the loan amount

RupeeQ Tip:

Small EMIs carry the same reporting impact as large ones. Missed payments are never “small” in credit terms.

Impact 7: Lifestyle Loans Affect Long-Term Loan Planning

When applying for major loans like:

- Home loans

- Business loans

- High-value personal loans

Lenders examine:

- Past borrowing behaviour

- Nature of credit usage

- Lifestyle versus need-based borrowing

A history dominated by lifestyle loans can:

- Reduce sanctioned amount

- Increase interest rate

- Delay approval timelines

When Lifestyle Loans Make Sense

Lifestyle loans are not inherently bad.

Responsible Use Scenarios

- One active lifestyle loan at a time

- EMI below 10 to 15 percent of income

- Clear repayment plan

- No upcoming major loan requirement

Used thoughtfully, these loans can help manage cash flow without harming credit health.

How to Use Lifestyle Loans Without Hurting Credit Health

Step 1: Limit the Number of Active Loans

Try to keep:

- Maximum 1 to 2 lifestyle loans at any time

Step 2: Track Total EMI Burden

Always calculate:

- All EMIs combined

- Ensure they remain below 35 to 40 percent of income

Step 3: Avoid Back-to-Back Loans

Spacing loans:

- Reduces enquiries

- Improves credit behaviour signals

- Prevents dependency patterns

Step 4: Prioritise Saving Over EMI Convenience

If you can afford a purchase with savings, avoid financing it.

How RupeeQ Helps You Understand Lifestyle Loan Impact

RupeeQ helps borrowers see the bigger picture of credit health, not just the credit score.

By analysing:

- Active lifestyle loans

- EMI-to-income ratio

- Credit mix quality

- Repayment behaviour

RupeeQ helps you understand whether your borrowing habits support or restrict long-term financial goals.

Key Takeaways

- Small lifestyle loans have long-term credit impact

- EMI stacking reduces future loan eligibility

- Unsecured lifestyle credit increases risk perception

- Credit score may remain stable while credit health weakens

- Responsible planning protects borrowing power

Frequently Asked Questions (FAQs)

1. Do small lifestyle loans affect credit score?

Yes. They are reported like any other loan and affect enquiries, EMIs, and repayment history.

2. Is one lifestyle loan harmful?

No. Occasional and planned usage is generally safe.

3. Can lifestyle loans affect home loan approval?

Yes. Too many lifestyle loans can reduce eligibility or increase interest rates.

4. Should I close lifestyle loans before applying for a big loan?

Reducing EMI burden improves approval chances.

5. Are lifestyle loans worse than credit cards?

Neither is bad. Overuse of either can weaken credit health.