Credit card debt can quickly become overwhelming, especially with high interest rates and compounding payments. If you’re struggling to clear your credit card balance, using a instant personal loan could be a practical solution. By consolidating debt with a lower-interest personal loan, you can save money and manage your payments more effectively.

In this blog, we’ll explore how personal loans can help you pay off credit card debt faster and share actionable tips to regain financial stability.

Why Credit Card Debt is Challenging to Manage?

Credit cards are convenient, but their high-interest rates and revolving credit nature can make repayment difficult.

Common Challenges:

- High Interest Rates: Credit cards often have annual percentage rates (APRs) ranging from 24% to 40%, significantly increasing your debt.

- Minimum Payment Trap: Paying only the minimum due leads to prolonged repayment timelines and higher interest costs.

- Multiple Bills: Managing multiple credit card bills can cause confusion and missed payments.

How a Personal Loan Helps in Paying Off Credit Card Debt?

Personal loans can be a game-changer for individuals stuck in a cycle of credit card debt. Here’s how they work:

Benefits:

- Lower Interest Rates: Personal loans often have lower interest rates than credit cards, helping you save on interest payments.

- Fixed Monthly Payments: Personal loans come with structured EMIs (Equated Monthly Installments), making it easier to plan your budget.

- Debt Consolidation: Combine multiple credit card balances into one personal loan to streamline your payments.

- Shorter Tenure: Personal loans typically offer a fixed repayment term, ensuring you clear your debt faster.

Example: Suppose you owe ₹1,00,000 on your credit cards with an interest rate of 30%. Taking a personal loan at 14% interest can cut your monthly payments and reduce overall interest costs.

Steps to Use a Personal Loan to Clear Credit Card Debt

If you are looking for solid steps to start clearing out your credit card debt using a personal loan then you can read them below:

1. Assess Your Credit Card Debt

Start by calculating your total outstanding balance across all credit cards, along with the applicable interest rates.

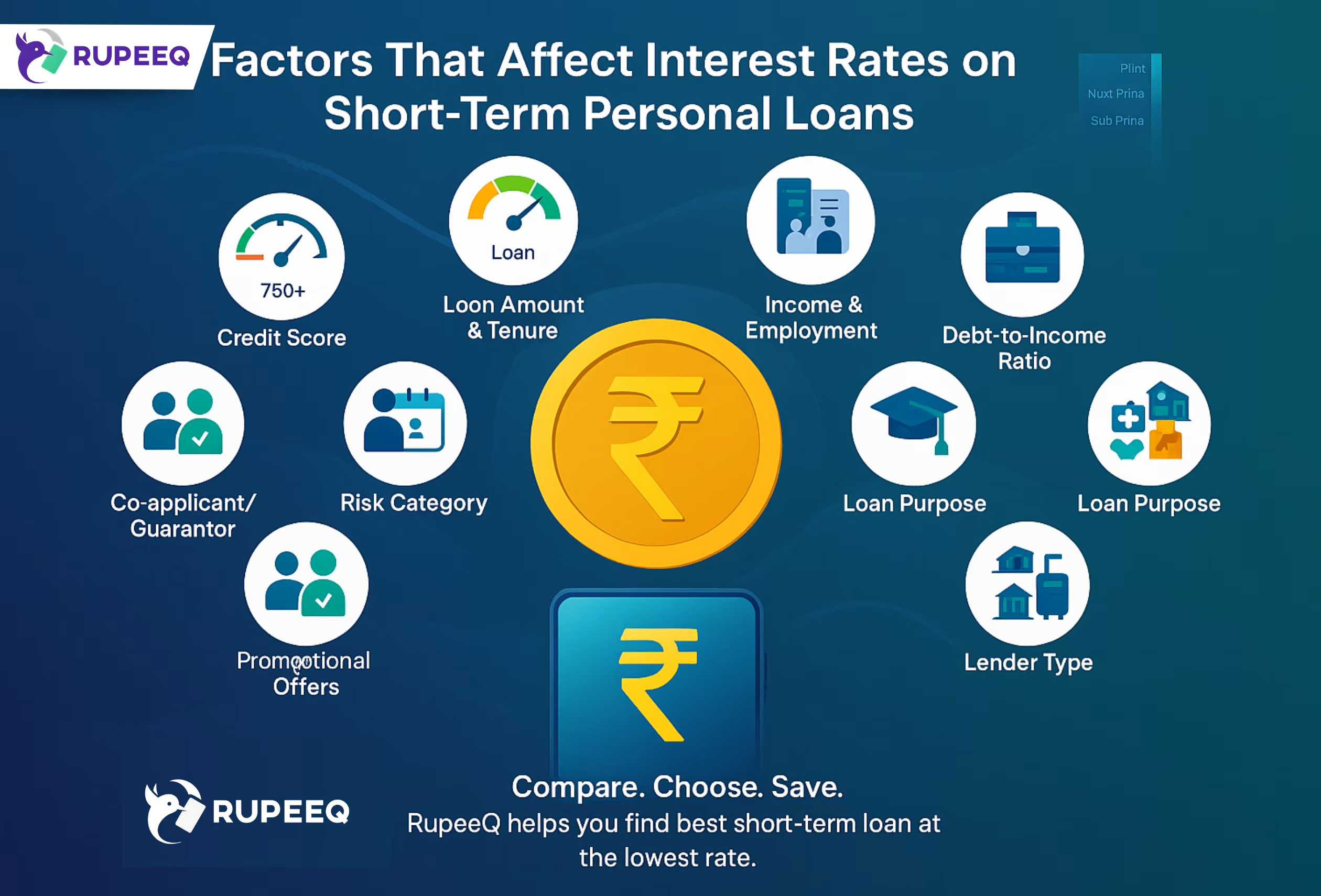

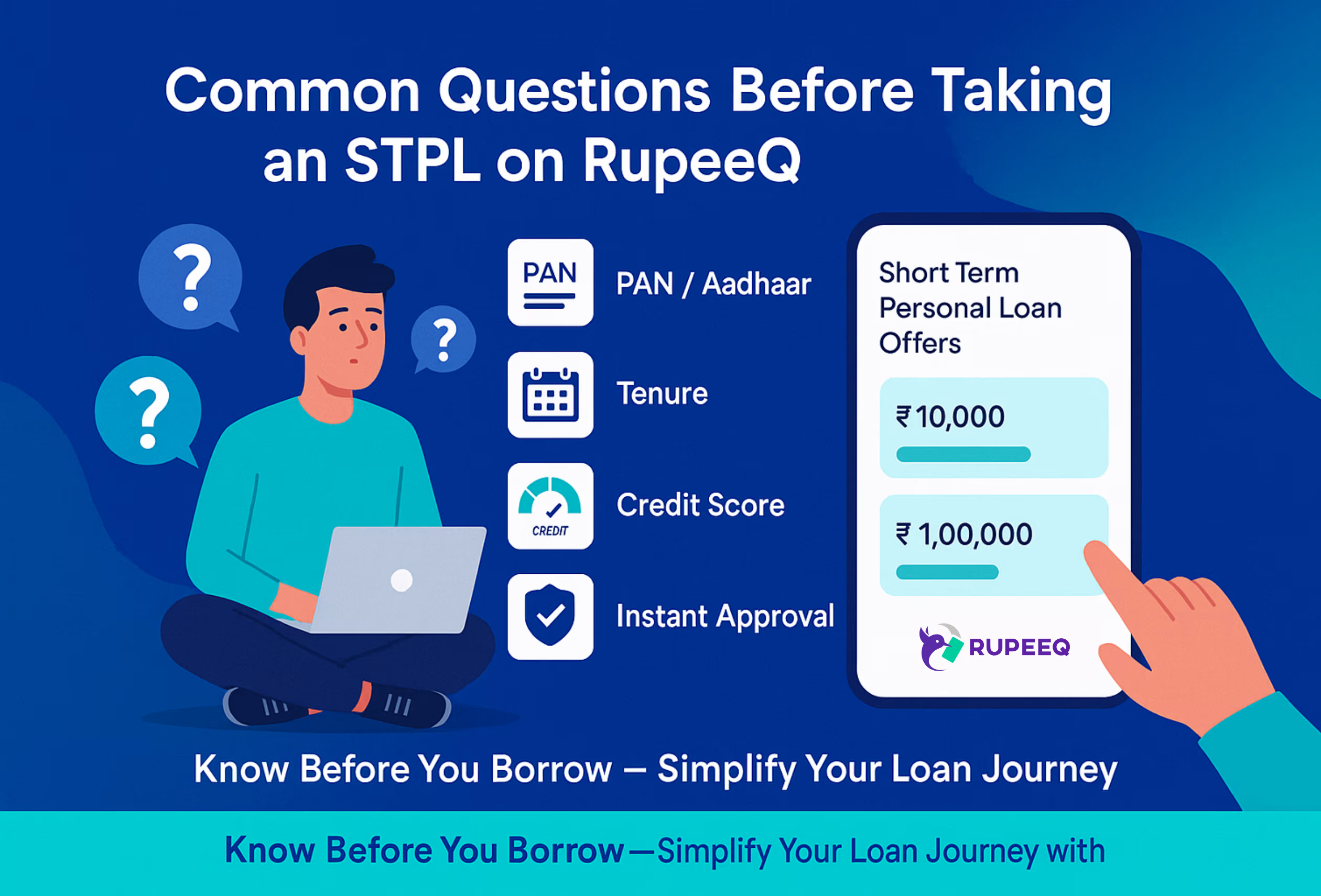

2. Check Your Eligibility for a Personal Loan

Banks and NBFCs (Non-Banking Financial Companies) offer personal loans based on factors like income, credit score, and repayment history.

3. Compare Loan Offers

Use platforms like RupeeQ to compare personal loans from various lenders. Look for:

- Low-interest rates

- Flexible tenures

- Minimal processing fees

4. Apply for the Loan

Once you’ve chosen a suitable loan, complete the application process. Keep your documents ready, such as proof of income, ID, and address.

5. Pay Off Credit Card Balances

Use the approved loan amount to clear all your credit card dues in full.

6. Focus on Loan Repayment

Stick to your EMI schedule and avoid accruing new credit card debt.

Advantages of Using a Personal Loan for Debt Consolidation

Apart from a simplifying way to pay off larger chunk of bills, there are following advantages of using a personal loan for debt consolidation:

1. Simplifies Finances

Managing one loan payment is easier than juggling multiple credit card bills.

2. Improves Credit Score

Clearing credit card balances reduces your credit utilization ratio, positively impacting your credit score.

3. Faster Debt Clearance

With structured repayment terms, you can eliminate debt faster compared to credit card minimum payments.

4. Predictable Payments

Personal loans have fixed monthly EMIs, ensuring no surprises or fluctuating interest charges.

RupeeQ Tip: After consolidating debt, avoid using credit cards for non-essential purchases to prevent a relapse into debt.

Factors to Consider Before Opting for a Personal Loan

While personal loans are a great tool for managing credit card debt, there are some factors you should consider:

1. Loan Interest Rate

Ensure the personal loan interest rate is significantly lower than your credit card APR.

2. Loan Tenure

Choose a loan tenure that balances affordability and faster repayment. Longer tenures reduce EMIs but increase total interest.

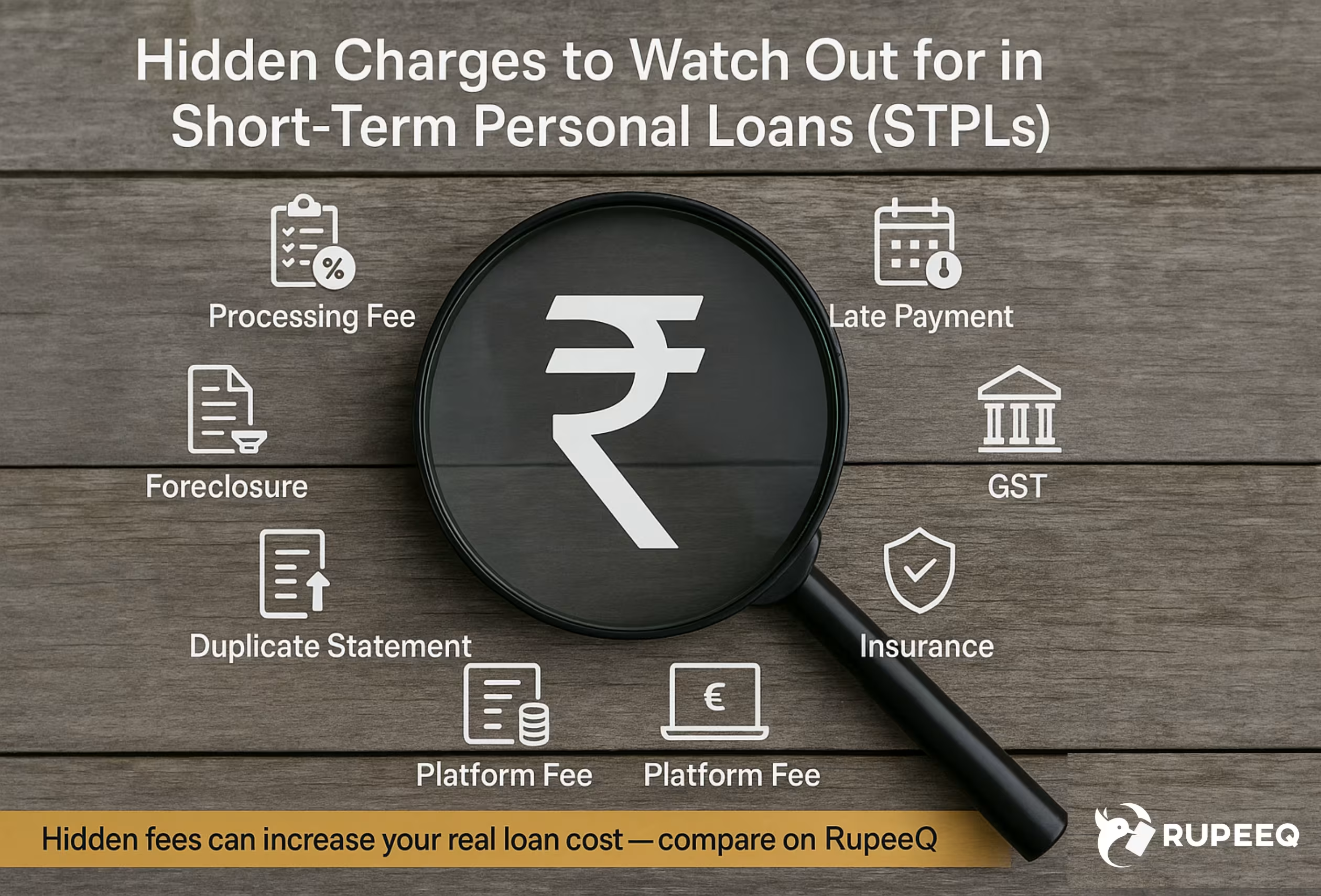

3. Processing Fees

Account for additional charges like processing fees, which can affect the overall cost of the loan.

4. Prepayment Options

Look for loans with no or low prepayment penalties to pay off the loan early if possible.

Also Read this Blog: Personal Loan Lower Interest Rates: What You Need to Know

Alternatives to Personal Loans for Managing Credit Card Debt

If a personal loan doesn’t seem like the right fit, you can explore these alternatives:

1. Balance Transfer Credit Card

Transfer your high-interest credit card debt to a card with a lower or 0% introductory rate.

2. Debt Snowball or Avalanche Method

Repay the smallest debts first (snowball) or focus on high-interest debts (avalanche) without consolidating.

3. Negotiate with Your Credit Card Provider

Request a lower interest rate or a repayment plan to ease your financial burden.

Success Tips for Staying Out of Debt

Consolidating credit card debt with a personal loan is just the first step. To ensure you stay debt-free, follow these habits:

1. Set a Budget

Track your monthly income and expenses to avoid overspending.

2. Use Credit Cards Wisely

Restrict credit card usage to essential purchases and pay the full balance every month.

3. Build an Emergency Fund

Having savings for unexpected expenses can help you avoid relying on credit cards.

4. Review Your Financial Goals

Regularly assess your financial health and make adjustments to stay on track.

RupeeQ Tip: Use RupeeQ’s free credit score check feature to monitor your financial progress and identify areas for improvement.

Final Thoughts

Paying off credit card debt with a personal loan is a smart way to regain control over your finances. By consolidating high-interest debts into a single, manageable loan, you can save money, simplify payments, and clear your dues faster.

Ready to take the first step? Explore personal loan options on RupeeQ, compare offers from top lenders, and choose the one that fits your needs. Make your journey toward a debt-free life a reality today.