A personal loan above ₹10 lakhs can help you finance major expenses such as home renovations, medical treatments, higher education, business expansion, or debt consolidation. While personal loans are typically unsecured, borrowing a high amount requires strong financial credibility, a high credit score, and proper documentation.

With RupeeQ, securing a high-value personal loan becomes easier as you can compare multiple lenders, check eligibility instantly, and apply online with minimal hassle. This guide will walk you through the step-by-step process to avail a personal loan above ₹10 lakhs on RupeeQ.

Check Your Eligibility for a High-Value Personal Loan

Before applying, ensure that you meet the eligibility criteria set by banks and NBFCs for loans above ₹10 lakh.

Common Eligibility Criteria

- Age Requirement:

- Salaried: 21 to 60 years

- Self-employed: 25 to 65 years

- Income Requirement:

- Salaried: ₹50,000+ per month

- Self-employed: ₹6 lakh+ annual income

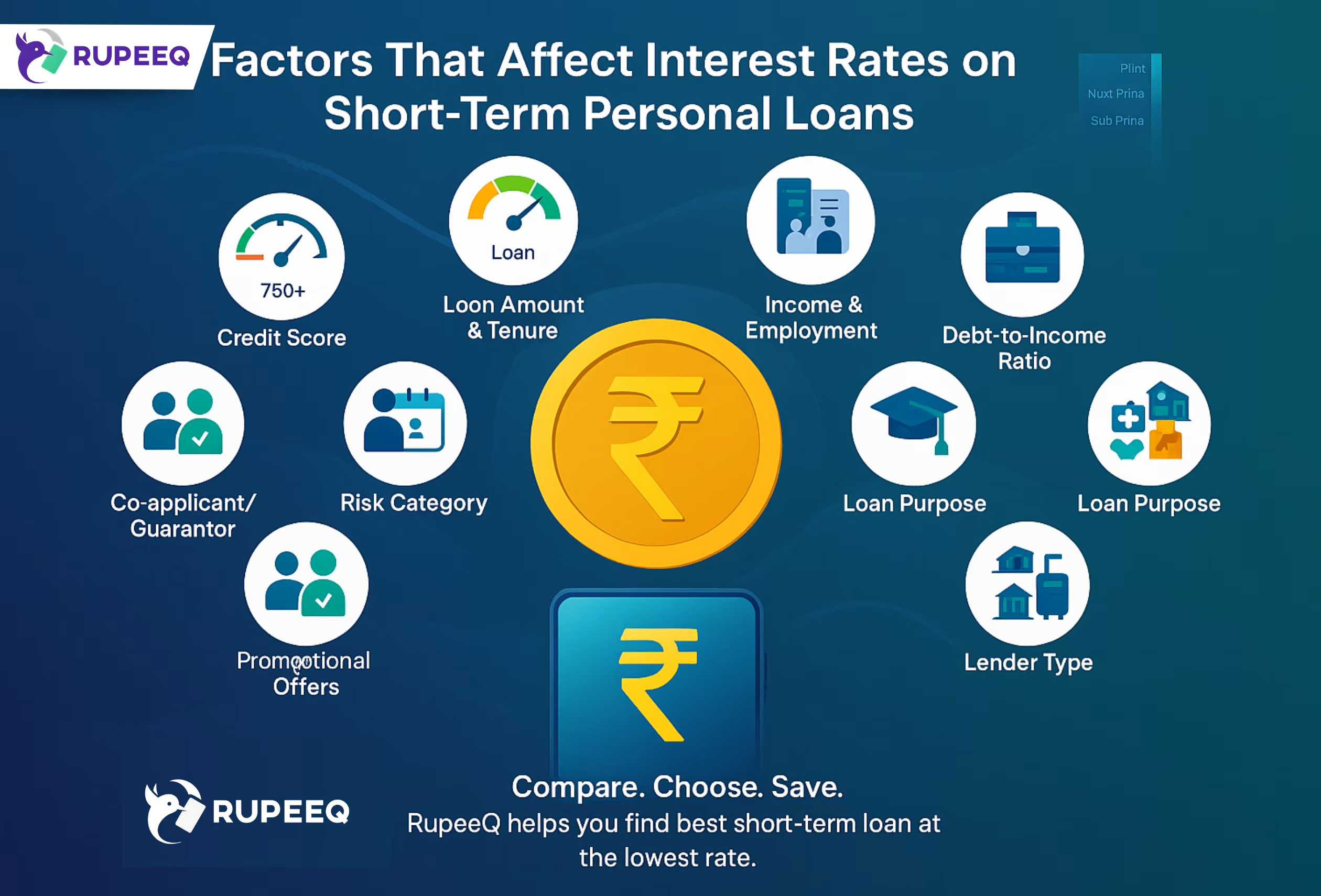

- Credit Score:

- 750+ for best loan offers

- 650-749: Moderate approval chances

- Below 650: Higher rejection risk

- Employment Stability:

- Salaried: Minimum 2 years of work experience, with 1 year in the current job

- Self-employed: Minimum 3 years of business stability

- Debt-to-Income Ratio:

- Your total loan EMIs should not exceed 40-50% of your monthly income

How RupeeQ Helps?

- Use RupeeQ Loan Eligibility Calculator to check if you qualify for a high-value personal loan.

- Get pre-approved offers for faster loan approval.

RupeeQ Tip – If your credit score is below 750, improve it before applying to get better interest rates and approval chances.

Compare Lenders to Find the Best Interest Rates

Interest rates for high-value personal loans vary by lender and depend on your creditworthiness. Even a 1-2% difference in rates can lead to significant savings over the loan tenure.

Current Interest Rate Range (₹10L+ Loans)

- Banks: 10% – 16% per annum

- NBFCs: 12% – 22% per annum

- Digital Lenders: 14% – 24% per annum

Example: Interest Rate Impact on ₹10 Lakh Loan for 5 Years

| Interest Rate | EMI (₹) | Total Interest Paid (₹) | Total Repayment (₹) |

| 10% | ₹21,247 | ₹2,74,820 | ₹12,74,820 |

| 12% | ₹22,244 | ₹3,34,622 | ₹13,34,622 |

| 14% | ₹23,268 | ₹3,97,834 | ₹13,97,834 |

Savings: Opting for a 10% interest loan instead of 14% saves nearly ₹1.2 lakh in total repayment.

How RupeeQ Helps?

- Compare interest rates from multiple banks and NBFCs in one place.

- Filter options based on lowest interest rates, zero processing fees, and flexible tenure.

RupeeQ Tip – If you have an existing relationship with a bank or lender, negotiate for a lower interest rate before applying.

Choose the Right Loan Tenure for Affordable EMIs

Selecting the right repayment tenure is crucial for balancing EMI affordability and total interest costs.

How Loan Tenure Affects Your EMI?

- Shorter Tenure (3-5 Years):

- Higher EMIs but less interest paid.

- Suitable for borrowers with high income.

- Longer Tenure (6-7 Years):

- Lower EMIs but more total interest paid.

- Suitable if you want affordable monthly payments.

Example: EMI for a ₹12 Lakh Loan at 12% Interest

| Tenure | EMI (₹) | Total Interest Paid (₹) |

| 3 Years | ₹39,857 | ₹1,42,655 |

| 5 Years | ₹26,692 | ₹2,00,773 |

| 7 Years | ₹21,015 | ₹2,66,508 |

How RupeeQ Helps?

- Use RupeeQ’s EMI Calculator to determine the most cost-effective tenure.

RupeeQ Tip – If your salary is expected to increase in the next 2-3 years, choose a shorter tenure to save on total interest.

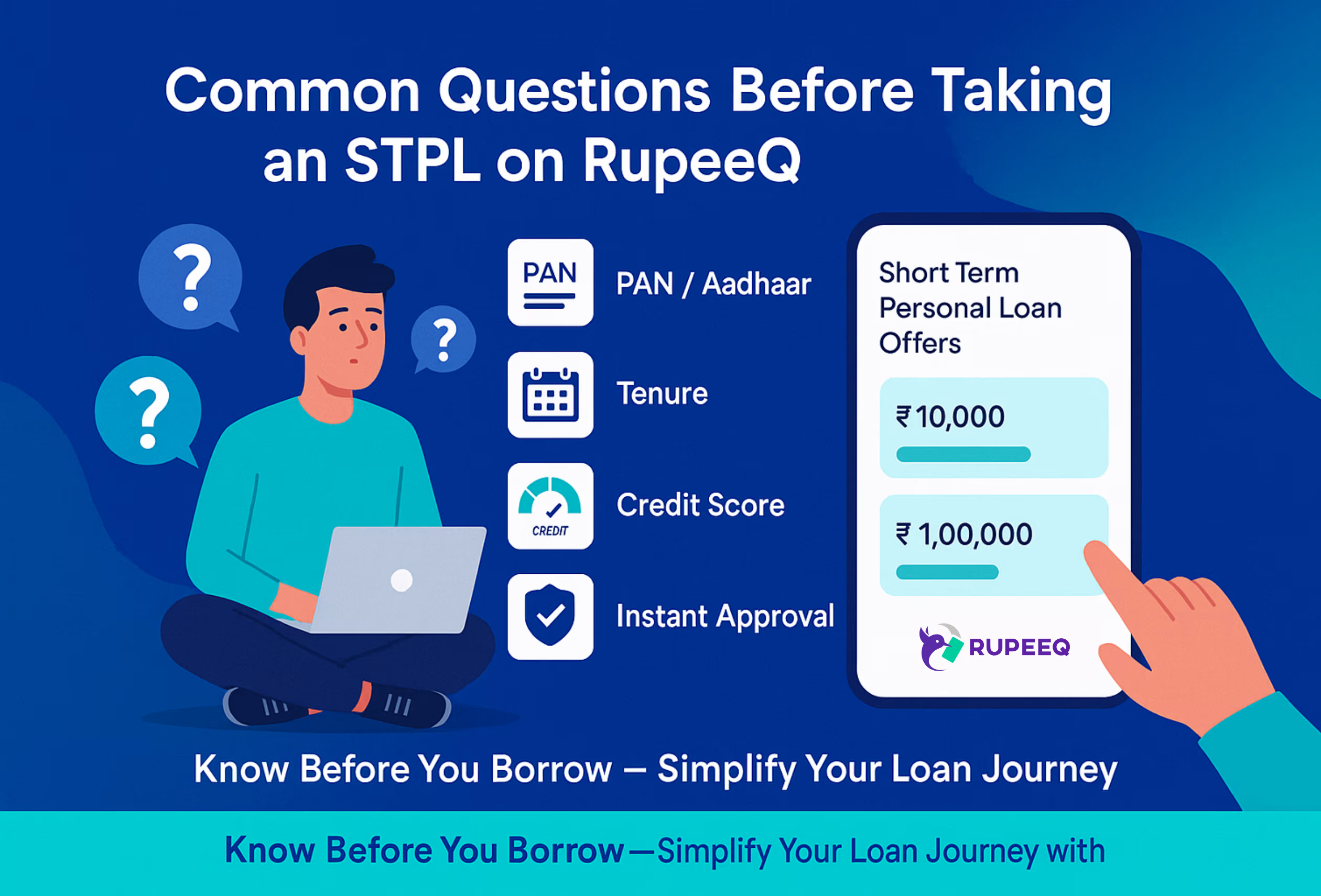

Prepare the Required Documents for Faster Approval

High-value personal loans require strong documentation to verify your income and creditworthiness.

Mandatory Documents for ₹10L+ Loans

For Salaried Applicants

✅ Identity Proof: PAN Card, Aadhaar, Passport

✅ Address Proof: Utility Bills, Rental Agreement

✅ Income Proof: Last 3 months’ salary slips, Form 16

✅ Bank Statements: Last 6 months

✅ Employment Proof: Offer Letter, Employee ID

For Self-Employed Applicants

✅ Identity & Address Proof: PAN, Aadhaar, Passport

✅ Business Proof: GST registration, Business license

✅ Income Proof: Last 2 years’ ITR filings

✅ Bank Statements: Last 6 months showing business transactions

How RupeeQ Helps?

- RupeeQ allows you to upload documents digitally by taking you directly to the lender’s portal for a 100% paperless loan application.

RupeeQ Tip – Keep all required documents ready before applying to speed up approval.

Submit Your Loan Application Online via RupeeQ

Once you have chosen the lender, tenure, and loan amount, the next step is to apply online via RupeeQ.

How to Apply for a ₹10 Lakh+ Personal Loan on RupeeQ?

1️⃣ Visit RupeeQ Personal Loan Page

2️⃣ Enter Loan Details (amount, tenure, purpose)

3️⃣ Check Eligibility & Compare Offers

4️⃣ Select the Best Lender with the lowest interest rate

5️⃣ Upload Documents Digitally on lender’s portal for fast processing

6️⃣ Get Instant Approval & Loan Disbursal within 24-48 hours

RupeeQ Tip – Avoid applying with multiple lenders at the same time, as this can reduce your credit score due to multiple hard inquiries.

Read also :Save Money on Personal Loan

Final Notes on Getting the Best Personal Loan Above ₹10 Lakhs with RupeeQ

A high-value personal loan requires careful planning, strong creditworthiness, and the right lender selection. RupeeQ simplifies the process by offering instant eligibility checks, loan comparisons, and digital applications for a seamless borrowing experience.

Key Takeaways:

✅ Check your eligibility before applying for a high-value loan.

✅ Compare lenders on RupeeQ to find the lowest interest rates.

✅ Choose the right tenure to balance EMI affordability & interest savings.

✅ Submit required documents digitally for fast approval.

Looking for a personal loan above ₹10 lakhs? Compare & apply instantly on RupeeQ today!