Short term personal loans (STPL) have become a go-to financial solution for many Indians who need instant access to funds without committing to long repayment periods. These loans—typically ranging from ₹5,000 to ₹1 lakh—are easy to avail, quick to disburse, and designed for urgent or planned short-term needs. Whether it’s a medical situation or a month-end cash crunch, STPLs help individuals bridge the gap without draining their savings.

Below, we explore the most common reasons why short term loans are gaining popularity in India, especially among young, urban borrowers.

1. Medical Emergencies with Immediate Expenses

Unexpected medical costs are one of the top triggers for short-term loan eligibility. Not every Indian has insurance, and even those who do often find themselves facing expenses not covered under policies.

Typical Use Cases:

- Hospital admission advance payments

- Diagnostic tests or pharmacy bills

- Minor surgeries or outpatient procedures

RupeeQ Tip:

Apply for a 3- or 6-month STPL via RupeeQ during medical emergencies for fast approval and disbursal, often within 24–48 hours.

2. Month-End Cash Crunch or Salary Delays

Many salaried employees—especially in startups or gig-based jobs—experience delays in salary credits or overspend during the month. Short term loans help tide over these temporary cash shortages.

Why It Works:

- Small ticket sizes (₹10,000 to ₹25,000)

- 30- to 90-day repayment cycles

- No need to dip into savings or break FDs

3. Home Repairs or Appliance Replacement

Repairing a leaking roof, fixing broken tiles, or replacing a refrigerator are often unavoidable—but they rarely come with advance notice. A short term loan gives borrowers immediate liquidity to manage such expenses.

RupeeQ Tip:

Avoid using high-interest credit card EMIs for home-related fixes. STPLs offer lower rates and fixed tenures.

4. Educational or Course-Related Costs

Many professionals upskill themselves through short certification courses or exams like IELTS, GMAT, or coding bootCamps. Parents may also need funds for school admission or project fees for their children.

Where STPL Helps:

- Online course fees

- Exam registration costs

- Travel and accommodation for tests/interviews

5. Travel or Vacation Funding

Last-minute travel plans—whether for a destination wedding, a solo trip, or a family vacation—often need upfront payments. Rather than disturb long-term investments, short term loans offer a smart alternative.

Borrowers Use It For:

- Airfare and hotel bookings

- Visa or travel insurance

- Event-related clothing and expenses

6. Debt Bridging or Loan Closure

Some borrowers use a short term loan to close an existing high-interest loan or manage a bounced EMI, especially when the alternative is late fees or a dip in credit score.

Example:

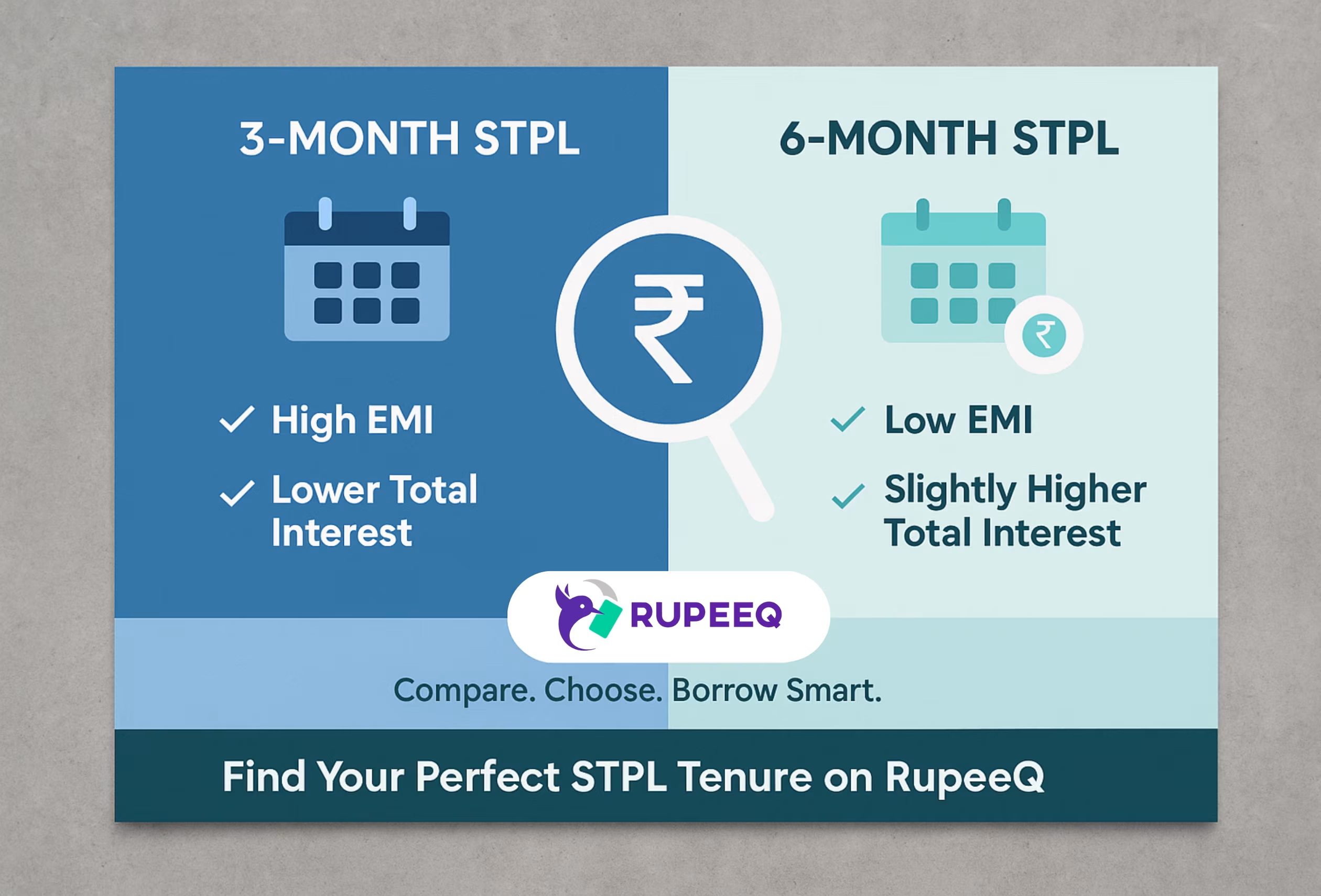

A borrower might take a 3-month STPL at 13% p.a. to pay off a 24% payday loan or missed EMI.

RupeeQ Tip:

Use the RupeeQ platform to compare STPL offers before closing other loans to ensure you’re actually saving on interest.

7. Weddings and Celebrations

Small expenses during weddings—like last-minute vendor payments, outfit rentals, or gifting—can quickly add up. Since not all expenses are part of the main budget, STPLs fill this gap.

Common Wedding Expenses Funded:

- Makeup artist advance

- Venue decoration changes

- Outstation guest transport

8. Business or Freelance Project Expenses

Small business owners, gig workers, and freelancers often need working capital for short-term inventory, travel, or project-specific needs.

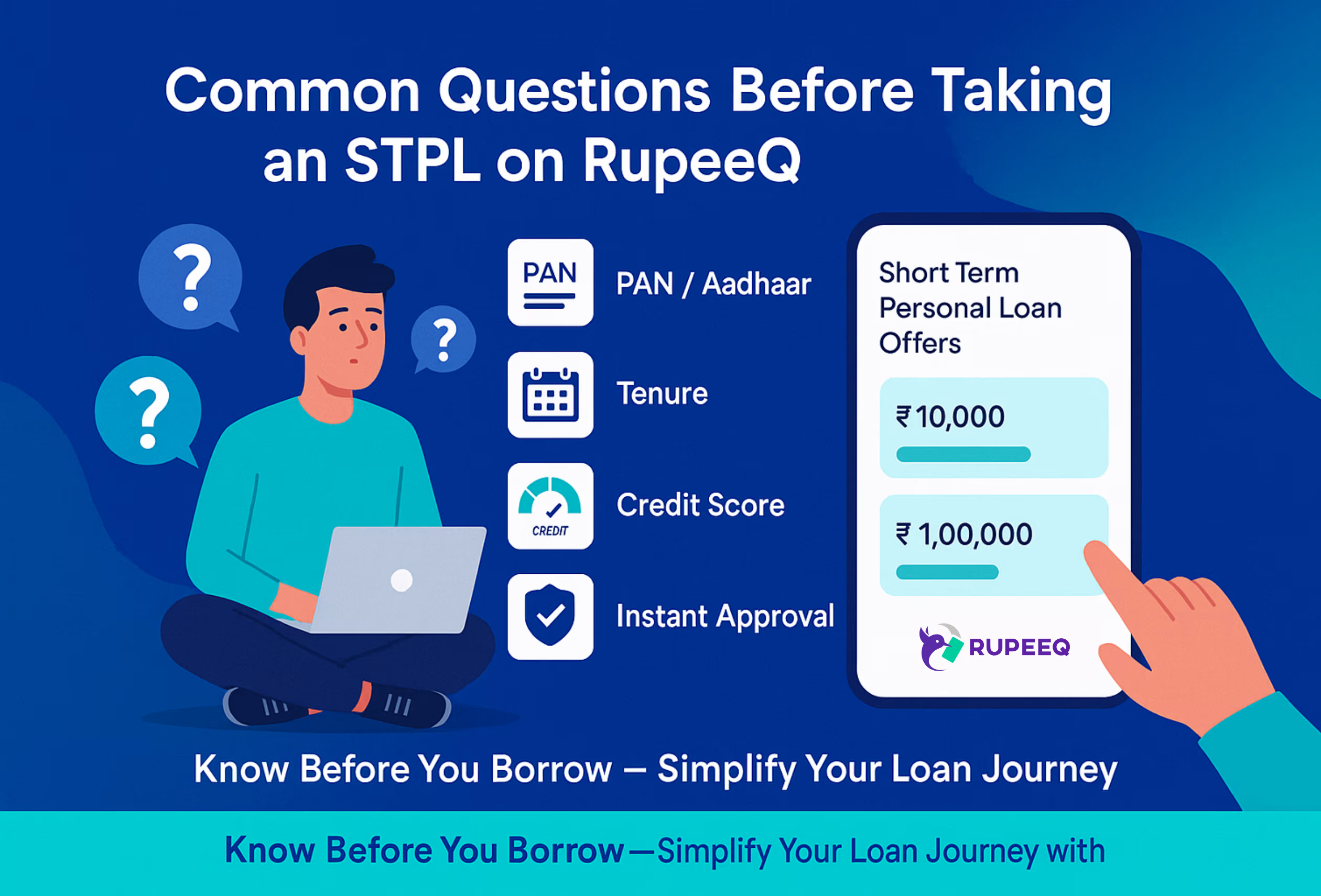

STPL Benefits for Professionals:

- No collateral required

- Quick documentation (PAN, Aadhaar, bank statement)

- Ideal for 3- to 6-month working capital cycles

9. Bond Deposits or New Rentals

Shifting to a new house or city requires advance rent, brokerage, or bond deposits, often amounting to 2–3 months of rent. Instead of borrowing from family or friends, many people opt for a short term loan.

10. Lifestyle or Gadget Upgrade

This includes buying a new phone, laptop, smartwatch, or home appliance that can’t wait until the next salary cycle. STPLs are a viable alternative to No Cost EMIs, especially if you’re not getting 0% deals.

Summary Table: Top 10 Uses of Short Term Personal Loans in India

| Use Case | Typical Loan Amount | Suggested Tenure |

| Medical Emergency | ₹10,000 – ₹50,000 | 3–6 months |

| Month-End Cash Shortage | ₹5,000 – ₹20,000 | 1–3 months |

| Home Repairs or Appliance | ₹15,000 – ₹50,000 | 3–6 months |

| Course or Certification Fees | ₹10,000 – ₹40,000 | 3–9 months |

| Travel or Vacation | ₹20,000 – ₹75,000 | 6–9 months |

| Debt Bridging or EMI Closure | ₹25,000 – ₹1,00,000 | 3–6 months |

| Wedding Expenses | ₹30,000 – ₹1,00,000 | 6–12 months |

| Freelance or Gig Projects | ₹15,000 – ₹75,000 | 3–6 months |

| Rental Advance or Deposit | ₹25,000 – ₹60,000 | 3–6 months |

| Gadget or Lifestyle Upgrades | ₹15,000 – ₹50,000 | 3–9 months |

Final Thoughts

Short Term Personal Loans are not just about urgent medical needs—they’re versatile, fast, and highly relevant for today’s financial demands. With flexible tenure, instant approvals, and minimal paperwork, STPLs are becoming the first choice for salaried individuals, freelancers, and even students who need short bursts of credit.

Use RupeeQ to compare short term loan offers across 15+ lenders and choose the one with the lowest cost, fastest disbursal, and repayment flexibility.