Becoming debt-free feels like a major financial milestone. No EMIs, no reminders, no stress. Naturally, many people assume that once all loans are closed, their credit score will automatically improve and stay strong.

But in reality, the relationship between being debt-free and your credit score is more nuanced.

For some people, the credit score improves after closing all loans. For others, it surprisingly drops. Understanding why this happens helps you plan your borrowing and repayment journey more intelligently instead of reacting to score fluctuations.

What Does “Debt-Free” Mean in Credit Terms?

From a credit bureau’s perspective, you are considered debt-free when:

- All active loans are fully closed

- No EMIs are running

- No outstanding balances are reported

- Only closed accounts appear in your credit report

This includes:

- Personal loans

- Home loans

- Auto loans

- Consumer durable loans

- Education loans

Credit cards are slightly different. A card with zero outstanding is still considered an active credit line.

Does Being Debt-Free Automatically Improve Your Credit Score?

The short answer is not always.

Your credit score is calculated using multiple factors, not just whether you have debt or not. When you close all loans, several score components change at the same time.

Some changes are positive. Others can temporarily work against you.

How Credit Bureaus View Active Debt

Credit scoring models do not penalise borrowing. They evaluate how responsibly you manage credit.

Active loans help demonstrate:

- Repayment discipline

- Ability to manage long-term commitments

- Consistency in meeting due dates

- Credit experience over time

When all loans are closed, that active behaviour disappears from current reporting.

Key Credit Score Factors Affected When You Become Debt-Free

Let us break down what actually changes inside your credit report.

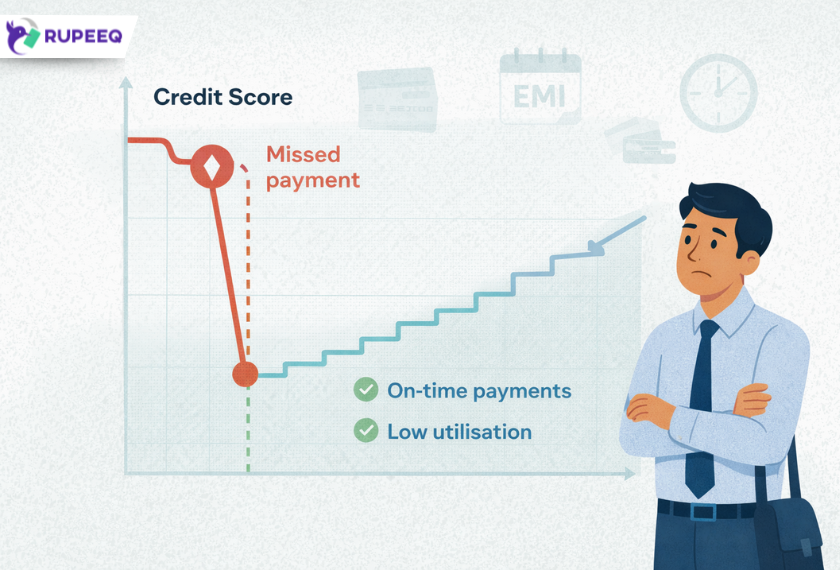

1. Repayment History Remains, But Becomes Passive

Your past repayment behaviour does not vanish. Closed loans with on-time EMIs continue to reflect positively.

However:

- There are no new positive repayment entries added every month

- Your credit activity becomes static

- Score growth may slow down

This is why some people notice their score plateau after becoming debt-free.

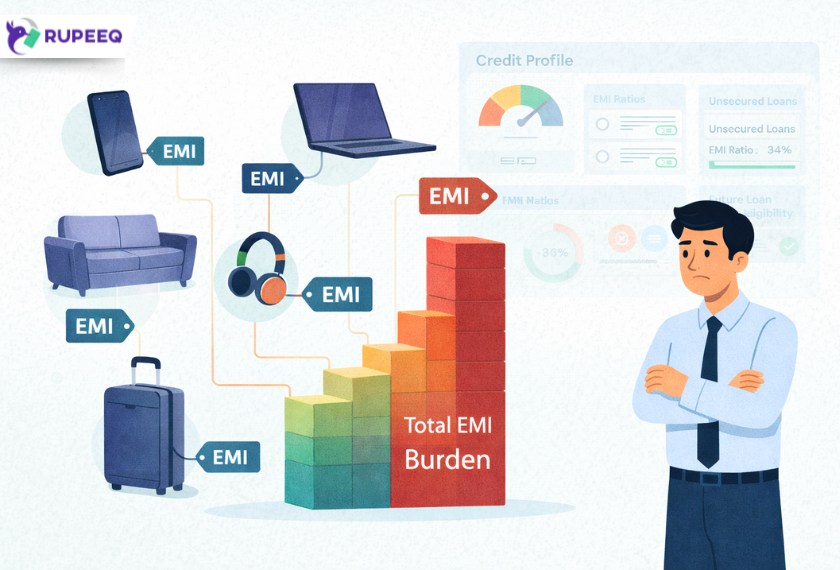

2. Credit Mix Can Shrink

Credit mix refers to the combination of:

- Secured loans

- Unsecured loans

- Revolving credit like credit cards

If you close all loans and only have a credit card left, your credit mix becomes limited.

Impact:

- Narrow credit exposure

- Less diversity in repayment behaviour

- Slight negative pressure on score in some profiles

This matters more for people planning large future loans like home loans.

3. Credit Utilisation May Improve or Become Irrelevant

If you had high utilisation earlier, becoming debt-free improves your profile significantly.

However:

- If no revolving credit exists, utilisation stops contributing positively

- Credit cards with zero usage do not add repayment data

Balanced utilisation is better than zero activity.

4. Credit Age May Reduce Unexpectedly

This is a commonly overlooked impact.

If your oldest loan was recently closed and no other long-standing accounts remain:

- Average credit age may reduce

- Score may dip temporarily

This happens especially when people close their first loan and do not maintain any active credit line.

5. Temporary Score Dip Is Normal After Loan Closure

Many borrowers panic when they see their score drop after closing a loan.

This happens because:

- Active credit behaviour stops

- Credit mix changes

- Account status shifts from active to closed

This dip is usually temporary, provided your overall profile remains healthy.

Example: How Going Debt-Free Affects Two Different Borrowers

Borrower A:

- Closed personal loan

- No credit cards

- No other active accounts

Result:

- Credit activity becomes zero

- Score may drop due to inactivity

Borrower B:

- Closed personal loan

- Keeps one credit card active

- Uses card lightly and pays on time

Result:

- Score remains stable or improves

- Credit behaviour continues to be reported

This difference is crucial.

6. Lenders Do Not Prefer “Zero Credit” Profiles

From a lender’s perspective:

- No active debt does not mean low risk

- It means lack of recent data

Lenders prefer borrowers who:

- Use credit responsibly

- Repay consistently

- Maintain financial discipline

Being debt-free is financially healthy, but from a credit lens, controlled credit usage is healthier than no usage.

7. How Long Does a Closed Loan Impact Your Credit Score?

Closed loans remain on your credit report for several years and continue to:

- Support repayment history

- Strengthen long-term profile

- Show past discipline

However, their influence gradually weakens without active accounts supporting them.

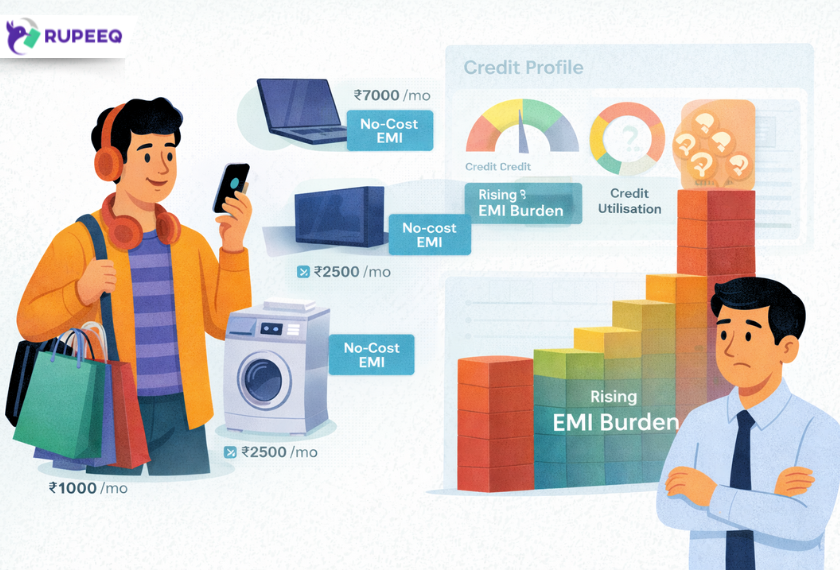

8. When Becoming Debt-Free Is Extremely Beneficial

Becoming debt-free works very well when:

- Your earlier utilisation was high

- You had multiple overlapping EMIs

- Cash flow was stretched

- Repayment stress existed

In such cases:

- Score improves

- Risk profile improves

- Lenders view you as more stable

9. When Becoming Debt-Free Can Work Against You

You need to be careful if:

- You are a thin-file borrower

- You close your only loan

- You do not maintain any active credit line

- You plan to apply for a big loan soon

This can lead to:

- Temporary score dip

- Limited credit history visibility

- Lower approval confidence

How to Stay Credit-Healthy After Becoming Debt-Free

You do not need to take unnecessary loans to maintain a good credit score.

Here are smart ways to stay active without falling into debt.

Maintain One Active Credit Line

- Keep one credit card

- Use it for small monthly expenses

- Pay full dues every month

Avoid Long Credit Gaps

- Long periods of zero activity can weaken profile strength

Do Not Close Old Cards Immediately

- Old cards help preserve credit age

- Closing them may reduce score stability

RupeeQ Tip:

Before becoming fully debt-free, review your credit profile to ensure at least one low-risk credit line remains active for long-term score health.

10. Planning a Loan After Being Debt-Free

If you plan to apply for:

- Home loan

- Business loan

- Higher-ticket personal loan

Ensure:

- At least 6 to 12 months of visible credit activity

- No recent score dips due to inactivity

- Clean repayment behaviour

This improves approval confidence significantly.

Final Thoughts

Becoming debt-free is an excellent financial achievement. It improves peace of mind, cash flow, and financial control.

But credit health is not about avoiding credit completely. It is about using credit responsibly and intentionally.

The goal should not be zero credit. The goal should be controlled, disciplined credit behaviour.

Understanding this balance ensures that your credit score continues to support your financial goals even after you close all loans.

FAQs: Credit Score After Becoming Debt-Free

1. Does closing all loans improve credit score?

It depends on your overall profile. Some see improvement, others see a temporary dip.

2. Why did my credit score fall after closing a loan?

Because active repayment behaviour stopped or credit mix reduced.

3. How long does a score dip last after loan closure?

Usually 2 to 4 months, provided no negative activity occurs.

4. Should I take a loan just to improve my credit score?

No. Use low-risk credit like a credit card instead.

5. Is it bad to have no active loans?

Financially no. Credit-wise, inactivity can limit score growth.

6. What is the best way to stay credit-active without debt?

Maintain one credit card with low utilisation and timely repayments.