A Loan Against Property (LAP) is a secured loan where you pledge your residential, commercial, or industrial property as collateral to borrow funds. It is an ideal option when you need a large loan amount at a lower interest rate compared to unsecured loans like instant personal loans.

Since your property serves as security, lenders offer higher loan amounts with longer repayment tenures, making it a cost-effective borrowing option for various financial needs. However, pledging a property is a big decision, so it’s essential to know when a LAP is the right choice.

This blog covers:

- What is a Loan Against Property and how it works

- Situations where LAP is the best financing option

- Pros and cons of taking a LAP

- RupeeQ insights on choosing the right lender

What is a Loan Against Property (LAP)?

A Loan Against Property (LAP) is a secured loan where you mortgage a property to avail funds for personal or business needs. The loan amount is determined based on the property’s market value and the borrower’s repayment capacity.

Key Features of Loan Against Property

- Loan Amount: Up to 60-75% of the property’s market value

- Interest Rate: 8% – 14% per annum (lower than personal loans)

- Repayment Tenure: 5 to 20 years

- Usage: No restriction; funds can be used for personal or business expenses

- Collateral: Residential, commercial, or industrial property

Since a LAP is a secured loan, lenders offer lower interest rates and higher loan amounts than unsecured loans.

When Should You Consider a Loan Against Property?

A Loan Against Property is best suited for situations where you need a large loan amount, lower interest rates, and a longer repayment tenure. Below are some scenarios where it makes sense to opt for a LAP.

When You Need a Large Loan Amount

A LAP is ideal when you need a high loan amount (₹10 lakh – ₹10 crore), as the loan amount is linked to your property’s market value.

Example:

- If your property is worth ₹1 crore, lenders may offer a loan of ₹60-75 lakh.

- In contrast, a personal loan typically has a lower borrowing limit (₹50,000 – ₹50 lakh).

When You Need Lower Interest Rates

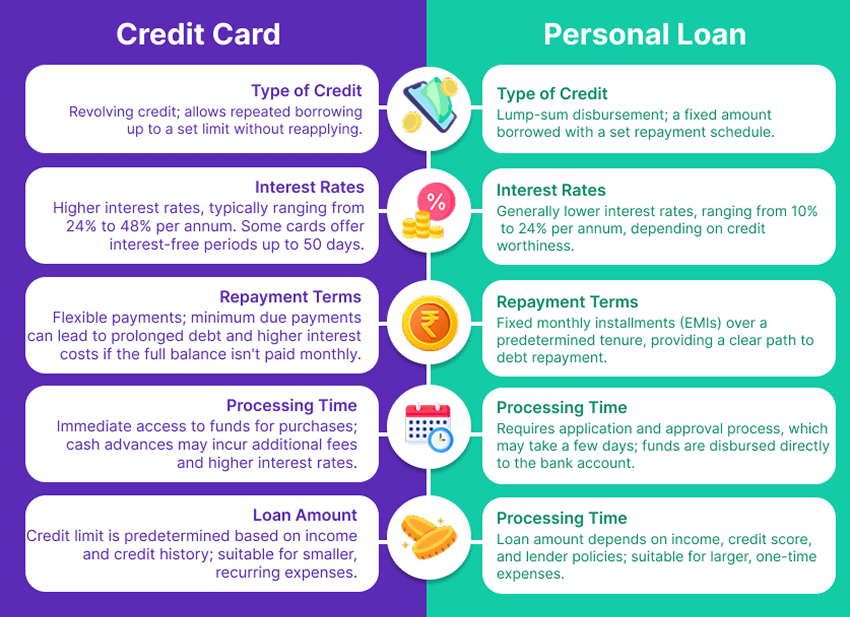

Since a Loan Against Property is secured, it comes with lower interest rates (8-14%) compared to personal loans (12-24%).

Example:

For a ₹30 lakh loan with a 10-year tenure:

| Loan Type | Interest Rate | EMI (₹) | Total Interest Paid (₹) |

| Loan Against Property | 10% | ₹39,645 | ₹17,57,375 |

| Personal Loan | 14% | ₹46,523 | ₹25,82,760 |

A LAP can save ₹8 lakh or more in interest compared to a personal loan.

When You Need a Longer Repayment Tenure

A LAP offers a repayment period of up to 20 years, making it easier to manage EMIs.

Example:

For a ₹50 lakh loan at 9% interest, choosing a 10-year tenure results in an EMI of ₹63,367, whereas extending the tenure to 15 years lowers the EMI to ₹50,714.

When You Want to Expand or Fund a Business

Business owners often opt for a LAP to:

- Expand operations or buy new equipment.

- Increase working capital to manage daily expenses.

- Clear outstanding business debts with a lower-cost loan.

Since business loans have higher interest rates (14-22%), using a LAP at 9-12% interest can be a cost-effective solution.

When You Need Funds for Medical Emergencies or Education

If health insurance does not cover a major medical expense, a LAP can provide the required funds at a lower cost than a personal loan or credit card loan.

Similarly, for higher education expenses, a LAP can be a better alternative to education loans, especially for international studies.

When You Want to Consolidate Debt at Lower Interest Rates

If you have multiple high-interest loans (personal loans, credit card debt, business loans), consolidating them into a single LAP at a lower interest rate can reduce your monthly repayment burden.

Pros and Cons of Taking a Loan Against Property

Advantages of LAP

Lower Interest Rates

A LAP offers significantly lower interest rates than unsecured loans.

Higher Loan Amount

You can borrow up to 60-75% of your property’s value, making it ideal for large financial needs.

Longer Repayment Tenure

With tenures up to 20 years, LAP allows for lower EMI payments, making repayment more manageable.

No Restrictions on Usage

Unlike home or education loans, a LAP can be used for any purpose, including business expansion, education, or medical emergencies.

Disadvantages of LAP

Risk of Property Loss

Since LAP is a secured loan, failure to repay can result in property repossession by the lender.

Longer Processing Time

Unlike personal loans that are approved within 24-48 hours, a LAP requires property evaluation and legal verification, which can take up to 7-15 days.

Higher Processing Fees

LAP processing fees (1-2%) are higher than those of personal loans.

Eligibility Criteria for a Loan Against Property

Lenders assess several factors before approving a LAP, including:

1. Age & Income

- Salaried: 21 – 60 years (₹25,000+ monthly income)

- Self-employed: 25 – 65 years (₹3-5 lakh annual income)

2. Property Type

- Residential, commercial, and industrial properties are accepted as collateral.

- Agricultural land is generally not accepted.

3. Loan-to-Value (LTV) Ratio

- Lenders offer 60-75% of the property’s value as a loan.

4. Credit Score Requirement

- A credit score of 700+ improves approval chances.

How to Apply for a Loan Against Property?

Step 1: Check Your Eligibility

Use the LAP Eligibility EMI Calculator on any bank’s or financial institution’s website to check the maximum loan amount you qualify for.

Step 2: Compare Loan Offers

Compare interest rates, processing fees, and repayment terms across banks and NBFCs.

Step 3: Submit Property & Financial Documents

- Identity & address proof

- Income documents (salary slips, ITR, business financials)

- Property ownership documents

Step 4: Property Valuation & Loan Approval

Lenders conduct property verification before approving the loan.

Step 5: Loan Disbursal

Once approved, the loan amount is credited to your bank account within 7-15 days.

RupeeQ Tip – To get the best LAP deal, compare lenders and negotiate processing fees before finalizing the loan.

Should You Opt for a Loan Against Property?

A Loan Against Property is a great option if you need large funds at a low-interest rate with flexible tenure. However, since your property is at risk, it is best suited for borrowers with a stable repayment capacity.

Key Takeaways:

- LAP is ideal for business expansion, medical emergencies, education, or debt consolidation.

- Lower interest rates and longer tenure make EMIs more affordable.

- Missing repayments can risk losing your property.

- Compare multiple lenders to find the best interest rates and loan terms.