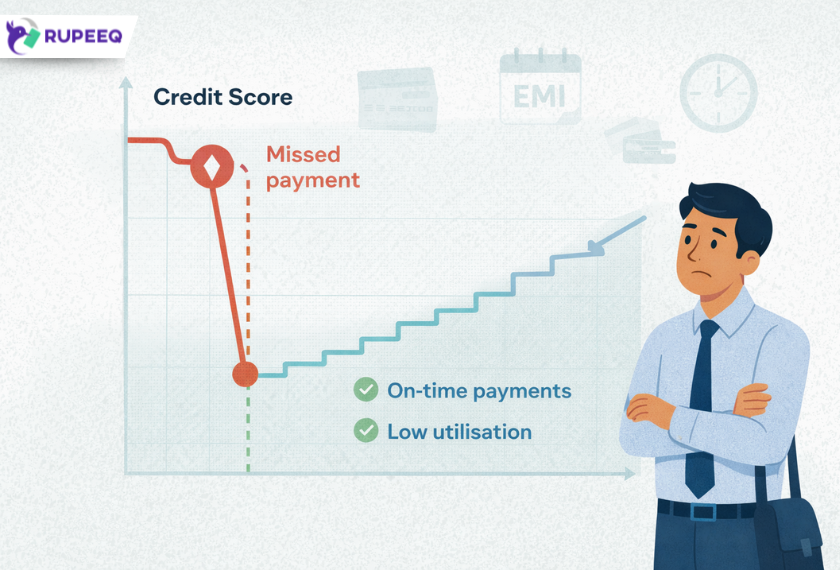

Many borrowers experience this frustrating pattern: one missed payment and the credit score drops sharply, but months of disciplined repayments barely move it upward. This often leads to a common question: why does my credit score fall so fast but take so long to recover?

The short answer is this: credit scoring systems are designed to punish risk quickly but reward discipline slowly. This may feel unfair, but it is intentional. Lenders want early warning signals of risk and long-term proof of reliability.

In this blog, we will explain why credit scores drop faster than they improve, how lenders interpret your credit behaviour, and most importantly, what practical steps you can take to fix and rebuild your credit score effectively.

How Credit Scores Are Designed to Work

Credit scores are not just mathematical totals. They are risk prediction tools built to answer one core question:

How likely is this borrower to default in the future?

To answer this, credit bureaus and lenders focus more on recent negative behaviour than old positive behaviour.

Why This Matters

A single mistake can signal financial stress

Consistent discipline over time proves stability

Risk detection is prioritised over reward

This is why recovery is slower than decline.

Reason 1: Negative Events Carry More Weight Than Positive Ones

Credit scoring models are loss-averse by design. This means they react strongly to negative signals.

Examples of High-Impact Negative Events

Missed EMI or credit card payment

30+ DPD (Days Past Due)

Loan settlement or restructuring

Credit card over-limit usage

Even one missed payment can undo months of good behaviour.

Why Positive Behaviour Takes Longer

Paying EMIs on time is expected, not exceptional

Positive behaviour must be repeated consistently

Lenders want long-term patterns, not short-term fixes

RupeeQ Tip:

Think of credit repair as reputation rebuilding. One mistake damages trust quickly, but rebuilding trust takes time and consistency.

Reason 2: Recency Bias in Credit Scoring

Credit scores are time-sensitive.

What you did recently matters more than what you did years ago.

How Time Impacts Credit Score

Missed payment last month → high impact

Missed payment 2 years ago → lower impact

On-time payments over 12–18 months → gradual improvement

This explains why:

Scores fall immediately after a default

Scores recover only after sustained discipline

Example Timeline

Event

Credit Score Impact

Missed EMI

Immediate drop

3 months on-time

Minor recovery

6 months on-time

Moderate recovery

12+ months

Strong improvement

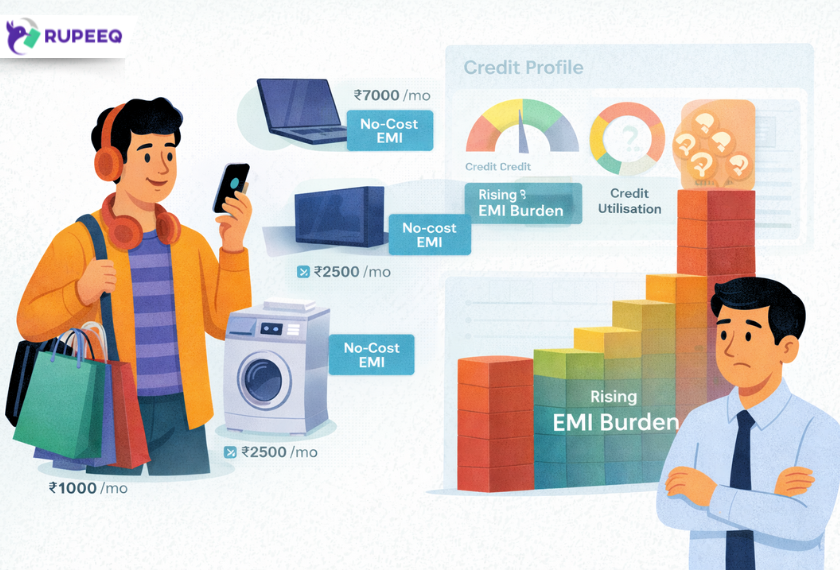

Reason 3: Credit Utilisation Corrects Slowly

Credit utilisation (how much credit you use vs what you have) is one of the most misunderstood factors.

Example:

Credit Card Limit: ₹1,00,000

Utilisation:

₹90,000 → Score drops quickly

₹30,000 → Score improves gradually

Why the Recovery Is Slow

High utilisation signals dependency

Reducing balances must be sustained

Temporary reduction doesn’t reset risk perception

RupeeQ Tip:

Lower utilisation consistently across billing cycles—not just once—to see real improvement.

Reason 4: Settlements and Past Defaults Take Time to Fade

Even after you clear dues, the history remains.

Common Misconception

“Once I paid everything, my score should bounce back immediately.”

Reality

Settlements remain visible

Late payments stay on record

Scoring impact reduces slowly over time

Why This Happens

Lenders care about patterns, not one-time corrections.

A settled loan suggests:

Financial stress at some point

Compromised repayment ability

Higher future risk than a clean closure

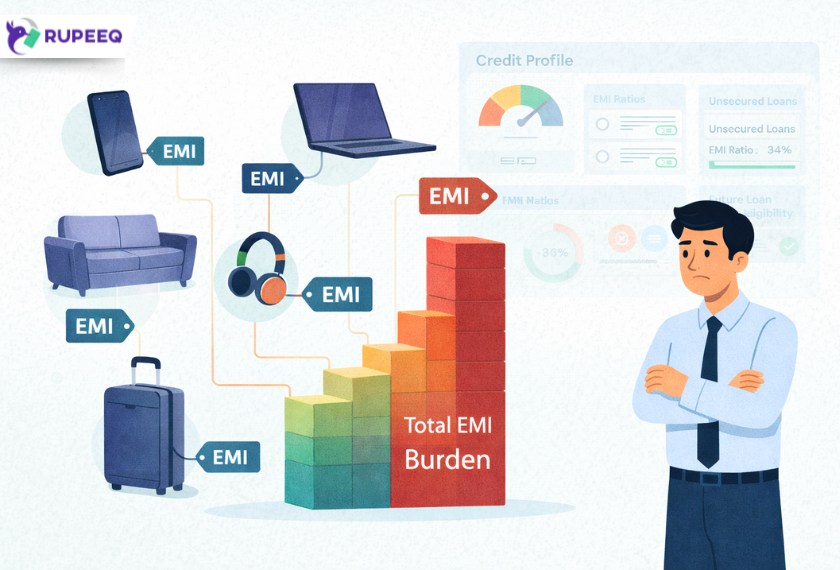

Reason 5: Credit Mix and Profile Depth Take Time to Build

A credit score also depends on how mature your credit profile is.

Thin Credit Profile Issues

Only one loan or card

Short credit history

Limited repayment data

Even with perfect behaviour, improvement is gradual because:

There’s less data to analyse

Risk prediction confidence is lower

Thick Credit Profile Advantages

Multiple loans/cards

Long repayment history

Diverse credit mix

This is why seasoned borrowers recover faster than new borrowers.

Why Credit Score Drops Feel Sudden (But Aren’t Random)

A score drop often feels sudden, but it usually reflects accumulated stress signals, such as:

Gradually rising utilisation

Increasing EMI burden

Multiple recent enquiries

Minor delays adding up

The drop happens when risk crosses a threshold.

How to Fix Slow Credit Score Recovery (Practical Steps)

Improving your credit score requires strategy, not shortcuts.

Step 1: Eliminate Missed Payments Completely

This is non-negotiable.

Set auto-debit reminders

Maintain buffer balance

Pay at least minimum due on credit cards

Even one missed payment can stall recovery for months.

Step 2: Reduce Credit Utilisation Systematically

Target utilisation:

Below 30% is ideal

Below 40% is acceptable

Example Plan:

Month 1: Reduce from 80% to 60%

Month 2: Reduce to 45%

Month 3: Reduce to 30%

Gradual reduction signals control and stability.

Step 3: Avoid Fresh Credit Applications During Recovery

Every new enquiry:

Slows recovery

Signals credit hunger

Adds uncertainty

RupeeQ Tip:

Pause new applications until your credit behaviour stabilises. Recovery is faster without fresh risk signals.

Step 4: Keep Old Credit Accounts Active

Closing old accounts reduces:

Credit history length

Available credit

Stability indicators

Instead:

Keep old cards active with small spends

Pay dues fully every cycle

Step 5: Focus on EMI Discipline Over Loan Closure

Many borrowers rush to close loans. While closure helps, repayment discipline matters more.

A closed loan removes ongoing positive signals.

Balanced approach:

Close high-interest debt

Maintain at least one active, well-managed account

How RupeeQ Helps You Understand Slow Credit Recovery

RupeeQ helps decode why your credit score is stuck, even when you feel you are doing everything right.

By analysing:

Active accounts

Utilisation patterns

Repayment consistency

Enquiry behaviour

RupeeQ provides actionable insights—not generic advice—so you know exactly what is holding your score back and how to fix it responsibly.

Key Takeaways

Credit scores fall fast due to risk sensitivity

Improvement requires sustained discipline

One-time fixes don’t work

Behaviour consistency matters more than intent

Smart planning accelerates recovery

Frequently Asked Questions (FAQs)

1. How long does it take to recover a dropped credit score?

Typically 6–12 months of disciplined behaviour, depending on the severity of past issues.

2. Can paying dues immediately restore my score?

No. Payment stops further damage, but recovery takes time.

3. Does checking my credit score slow recovery?

Checking your own score does not impact it.

4. Why is my score not improving despite timely payments?

High utilisation, past defaults, or limited credit history may be slowing progress.

5. What is the fastest safe way to improve credit score?

Timely payments, low utilisation, fewer enquiries, and patience.