Can You Prepay a Personal Loan? Here’s What You Need to Know

March 21, 2025

March 21, 2025

A personal loan comes with a fixed repayment schedule, typically spanning 1 to 7 years. However, if you

Top Features of Personal Loans for Salaried Individuals

March 21, 2025

March 21, 2025

For salaried individuals, a personal loan is one of the most convenient financial tools for handling emergencies, home

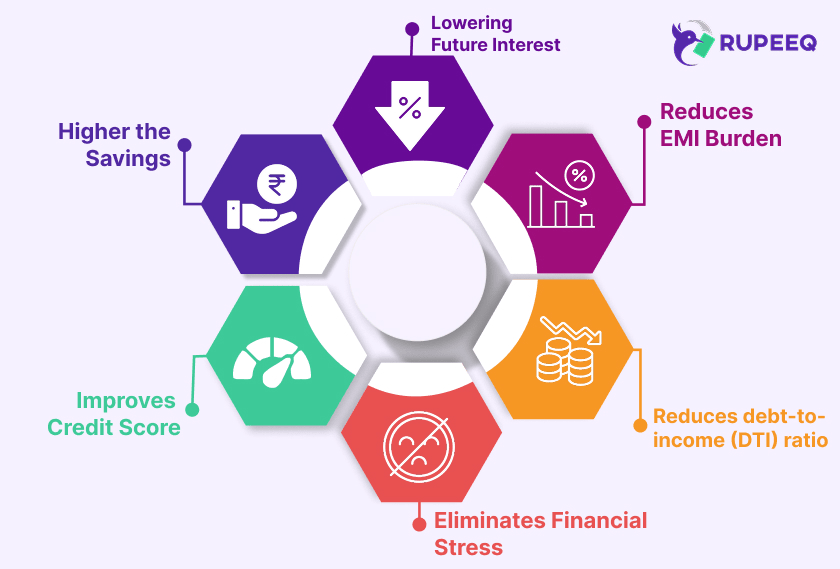

How to Use a Personal Loan for Debt Consolidation

March 20, 2025

March 20, 2025

Managing multiple debts such as credit card bills, medical loans, and personal loans can be overwhelming. High-interest debts,

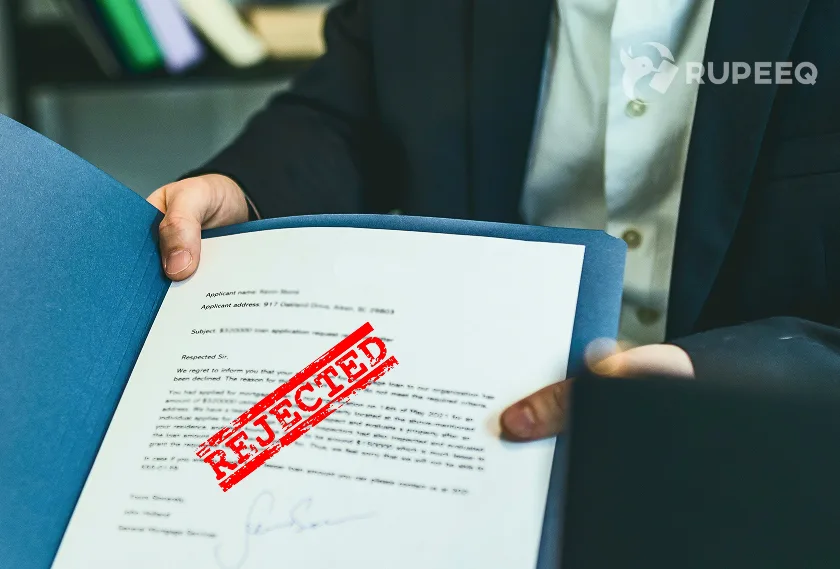

Top 5 Reasons Why Your Personal Loan Application May Be Rejected

March 20, 2025

March 20, 2025

Applying for a personal loan can be an effective way to cover emergency expenses, debt consolidation, home renovations,

How to Increase Your Chances of Personal Loan Approval

March 20, 2025

March 20, 2025

Applying for a personal loan can be a great way to manage unexpected expenses, home renovations, medical emergencies,

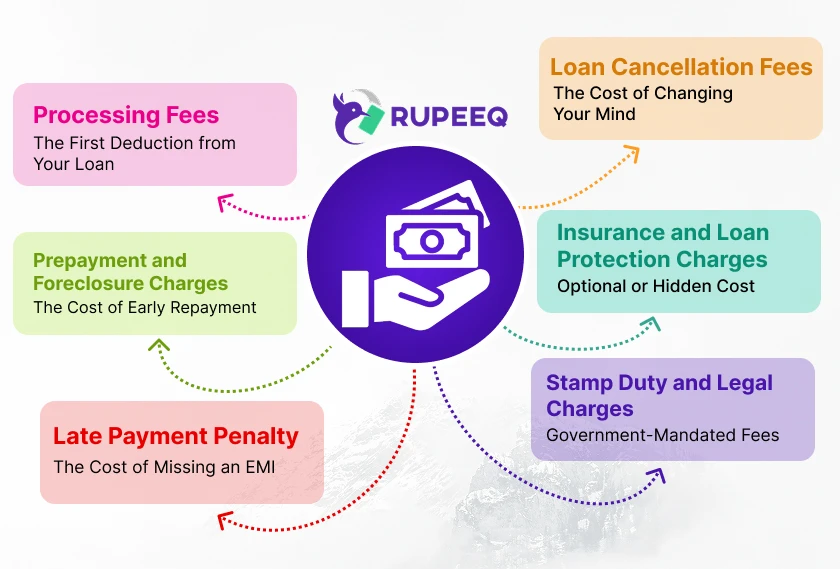

What Are the Hidden Costs of Personal Loans?

March 20, 2025

March 20, 2025

A personal loan is often considered a quick and convenient way to meet financial needs, whether for medical

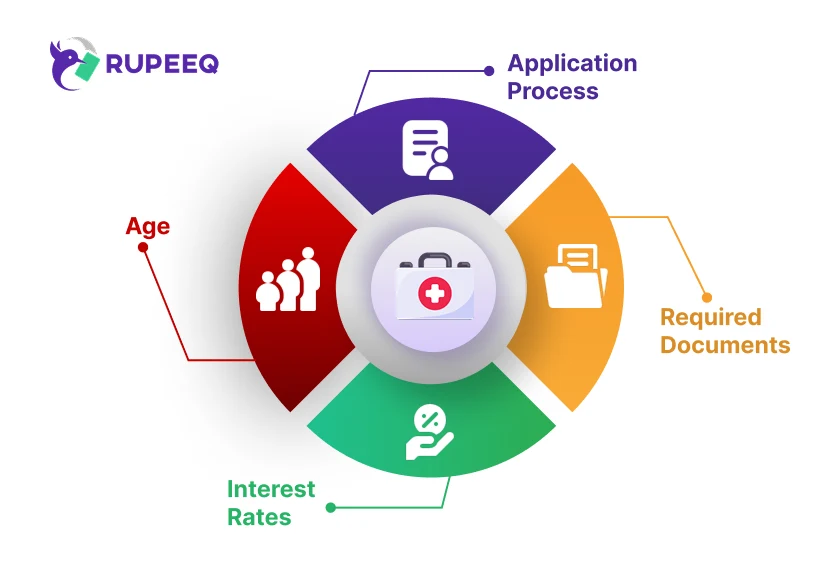

How to Secure a Personal Loan for Medical Emergencies

March 19, 2025

March 19, 2025

Medical emergencies often come unannounced and require immediate financial assistance. In such situations, a personal loan for medical

How to Avoid Common Mistakes When Taking a Personal Loan

March 19, 2025

March 19, 2025

A personal loan can be a great financial tool for managing unexpected expenses, home renovations, medical emergencies, weddings,

5 Factors to Consider Before Applying for a Personal Loan

March 17, 2025

March 17, 2025

A personal loan can be a convenient financial solution when you need funds for medical emergencies, home renovations,

How a Good Credit History Affects Your Loan Eligibility

March 17, 2025

March 17, 2025

When applying for a personal loan, home loan, car loan, or credit card, one of the first things

| Personal Loan Interest Rates Jan, 2026 | |

|---|---|

| Axis Bank | 10.75% - 26.00% |

| Bajaj | 11.00% - 28.00% |

| Chola Mandalam | 15.00% - 24.00% |

| IDFC | 11.00% - 24.00% |

| Kotak Bank | 11.00% - 18.00% |

| L & T Finance | 13.00% - 28.00% |

| TATA | 11.00% - 26.00% |